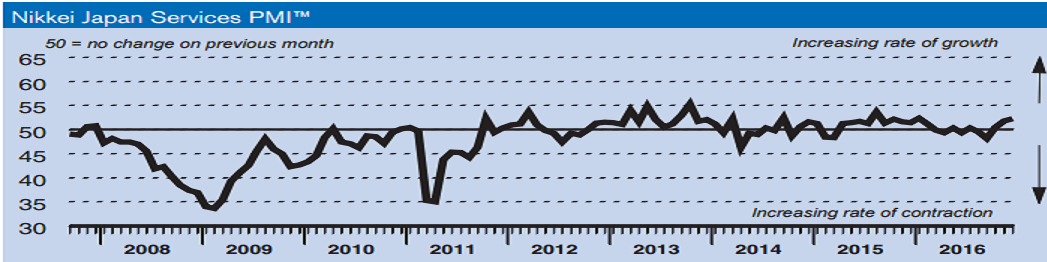

Growth of business activity in Japan jumped to 11-month high during December, following rapid expansion in new orders, which rose at the quickest rate in nearly one-and-a-half years. Subsequently, pressure on capacity started to build and volumes of unfinished business rose for the first time in six months.

The headline seasonally adjusted Business Activity Index posted 52.3 in December, up from 51.8 in November, signalling a stronger expansion in activity at Japanese service providers. Moreover, the latest reading was the highest since January and contributed to the highest quarterly average since Q4 2015.

Contributing to the rise in activity was a solid expansion in new orders. In fact, the rate of expansion was the quickest since July 2015, with a number of firms mentioning the opening of new stores and new clients. Resulting from stronger new order growth, pressure on capacity at Japanese services firms started to build, as volumes of unfinished work increased.

On the price front, input prices rose at a solid rate and one little-changed from November’s 23- month peak. Charges on the other hand declined, albeit only slightly. Forecasts towards output over the coming year were less optimistic in December, however, with the degree of business sentiment easing to a five-month low.

Finally, forecasts towards the outlook were relatively subdued in December, with mentions of greater raw material and fuel costs, labour shortages and increased price competition weighing on confidence.

Meanwhile, USD/JPY traded at 102.15, down -0.54 percent, while at 6:00GMT, the FxWirePro's Hourly Yen Strength Index remained neutral at 70.88 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off