Today sees the latest public release of the Nikkei Flash Japan Manufacturing Purchasing Managers’ Index (PMI). Published on a monthly basis approximately one week before final PMI data are released, this makes the PMI the earliest available indicator of manufacturing sector operating conditions in Japan. The estimate is typically based on approximately 85–90 percent of total PMI survey responses each month and is designed to provide an accurate indication of final PMI data.

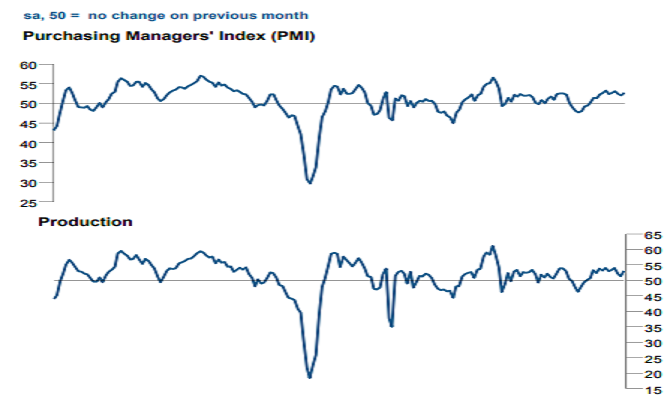

Flash Japan Manufacturing PMI improved to a three-month high of 52.8 in August, from 52.1 in July and the Flash Manufacturing Output Index at came in at 53.1, higher than the 51.4 witnessed in July, also registering the fastest growth in three months.

"August’s PMI survey provided another positive set of data on the health of Japan’s manufacturing sector, with growth rates of output, new orders, and employment all improving. Expansion continues to be supported by a mix of strengthened demand from both domestic and external sources: public work projects and stronger sales to South East Asia were both reported by panellists as areas of growth in August," said Paul Smith, Director at IHS Markit, which compiles the survey.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains