The BoJ had initially expected that CT hikes will alleviate households' future concerns about fiscal conditions and the social security system, and, therefore, were intended to have a positive effect on consumption. However, no such positive effect (so-called "relief effect") has been observed, so it appears the CT hike was prematurely implemented.

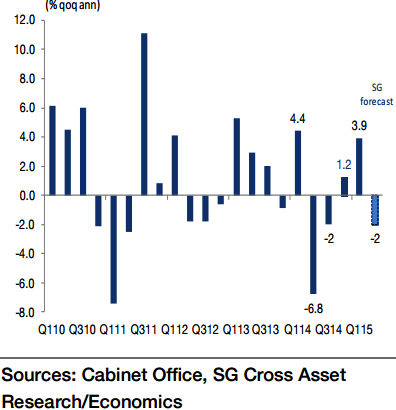

"Japan's Q2 real GDP is expected to temporarily show a negative growth of -0.5% qoq or an annualised rate of -2.0%. Real consumption is likely to have slowed to -0.4% qoq in Q2 after +0.4% qoq in Q1. This should be mainly due to abnormal weather which put downward pressure on consumer spending", says Societe Generale.

A later-than-usual start to the summer sales in department stores this year (only started in July) is likely to have had an impact on consumption in Q2. Although wages have been increasing since the start of the new fiscal year in April, consumer sentiment has remained weak since the consumption tax (CT) hike in April 2014.

As PM Abe has already announced that the second CT hike scheduled in April 2017 will not be delayed again, this has probably been suppressing consumer sentiment. As the "relief effect" did not occur, the government will need to reconsider the implementation of the second consumption tax hike.

Japan's Q2 GDP growth to be temporarily negative

Monday, August 17, 2015 4:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX