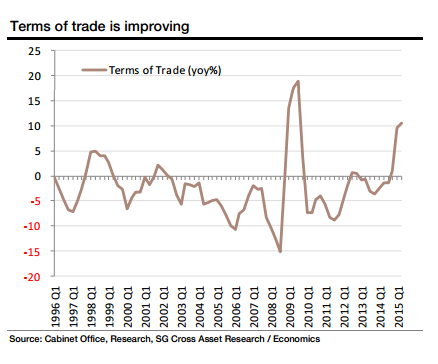

At present, thanks to the improvements in terms of trade stemming from the fall in oil prices, for example, households are no longer facing the challenge explained above. Terms of trade (export deflator/import deflator) have been improving substantially from -3.6% in Q4 2013 to +9.6% in Q1 2015. The current account balance also improved to ¥2.1 tn in March 2015 (the latest data for May is also strong at ¥1.6 tn), up from ¥0.66 tn in January 2014. As a result, wealth transfers from corporates to households are continuing. In addition, overseas transfers of income sparked by rising fuel costs are decreasing rapidly

Against this backdrop, the household savings rate has enjoyed a V-shaped recovery. As terms of trade improved, the burden on households has eased. As a result, household fundamentals have already recovered. As an expansion in aggregate wages is expected, the majority of increased cash is likely to be consumed. Thus, domestic demand is most likely to expand ahead.

Japan's household savings rate is now recovering thanks to improved terms of trade

Tuesday, July 21, 2015 1:38 AM UTC

Editor's Picks

- Market Data

Most Popular

3

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed