- Japan Preliminary GDP Growth Rate: It was scheduled to be released today and raised to 0.6% in the Q1 of 2015 over the previous quarter as reported by the Cabinet Office, Japan while forecast was at 0.4%.

- Japan Private Consumption QoQ: Consumer spending is printed at 0.4%. The same in Japan was increased to 308258 JPY billion in the Q4 2014.

- Japan's Q1 capital expenditure: Japan's gross fixed capital formation is increased to 107084.60 JPY billion in Q1 of 2015 from 106934.30 JPY billion in Q4 of 2014.

In addition the flash manufacturing PMI and industrial activity MoM numbers are coming up this week, we suppose Japan is geared up for economic growth.

As the country has accounted the increased export volumes worth of 6927 JPY billion from previous 5941 JPY billion and this is quite higher than their imports at 6698 JPY million, the Balance of Trade stood at 229 JPY millions which is good sign of international trade.

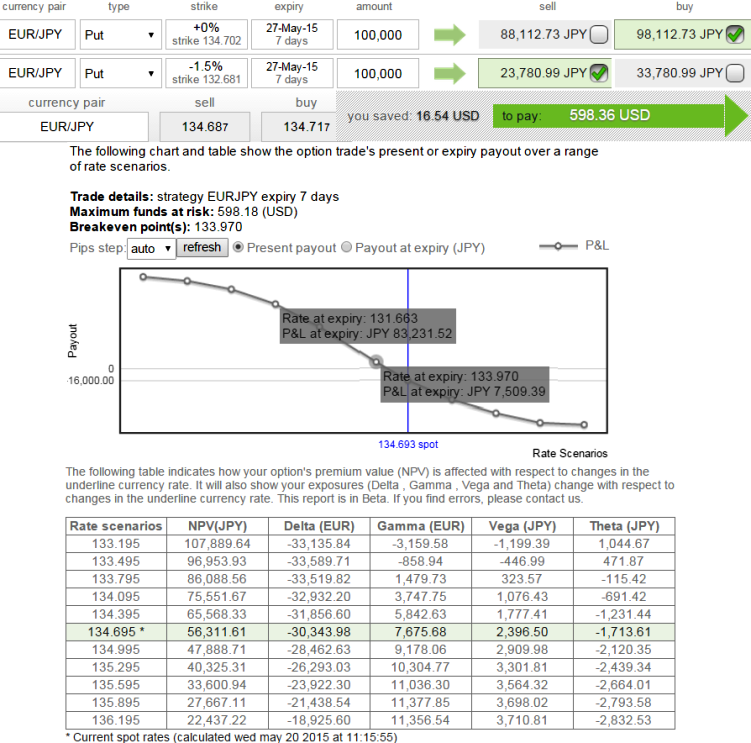

Euro/JPY hedging strategy: EUR/JPY

As we make out a further appreciation in JPY currency on technical terms, simple bear put spread can offer a partial hedging on this pair.

This partial hedge strategy minimizes the potential losses if the underlying currency has to move lower but does not cap the loss.

Bear Put Spread shall be used over Protective Put when the premiums on Protective Puts are too costlier.

Bear Put Spread = Protective Put + Sell another Put with lower Strike Price (Out of the Money).

But the advantage is that this strategy reduces the cost of hedge by the premium collected on the Out of the money Put but it comes at the expense of Partial hedge rather than a complete hedge

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary