- There is no question that growth prospect in US is improving along with the job market specially in pay roll numbers that last week showed an impressive gain by 295,000.

- Moreover initial jobless claims hovering around the levels last seen in 1980s.

- Unemployment rates fallen below 5.5%. According to FED officials, unemployment rate between 5.2-5.5% is normal and sustainable.

- Growth has averaged above 2% in 2014.

Real questions -

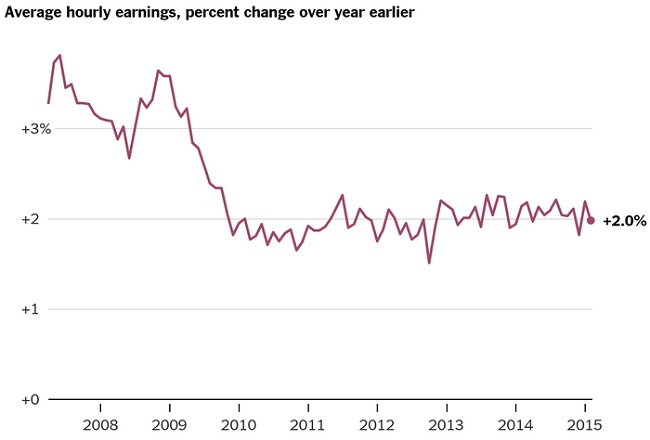

- If the Job market is so fantastic, why isn't the pay rising? Notably wage growth in US remained sluggish since 2010 and averaging about 2 percent, much lower than pre crisis level as explained in the chart.

- Is the first rate hike date is more important than the rate path? Probably not. So far market has remained fixated over the first rate hike, especially the dollar. That leaves lot of room in asking what happens afterwards it raises rates in June. FED officials have reiterated over and over that the hike would be slow and gradual. In such a circumstance Dollar could run out of fuel after June.

Dollar index is currently trading at 97.4, still continuing its consecutive 9 monthly rise.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate