Oil price drop and sharp decline inactive rig counts are expected to weigh on Future employment statistics.

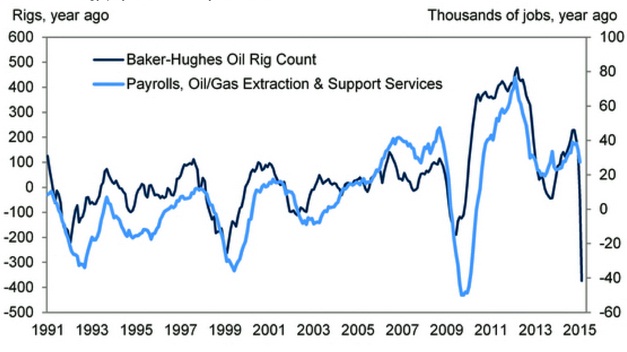

- Active oil rigs has fallen sharply close to 50% since its peak last year. Historically speaking number of rigs and unemployment in the sector has high correlation. Job losses usually follow after falls in rig count.

- Despite fall in number of rigs, US production has continued growth. This trend shows that US oil companies are moving to a phase of higher efficiency to compete with their low cost producing counterparts in Middle East and Russia.

- Moreover, companies are shelving future projects or new rig development for now. That will also lead to job losses and pay cuts across the industry. Recent PMI reports noted that new orders have dried down from the petroleum sector. Ancillaries and vendors catering to the petroleum sector might as well cut jobs.

This week's NFP will be closely monitored for industry watchers for such signs. Last month's NFP report saw job losses in the sector in tune of 7000, which is expected to deteriorate further. Chart explains the relation and job losses from historical perspective. Chart courtesy Business Insider.

Weaker than expected NFP and any rapid deterioration would weigh heavily on US dollar. Dollar index might go for a double top formation, should the NFP surprise big time to downside. Dollar index is trading at 98.4, up 0.50% today.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate