Today the weekly jobless claims data was published at 1.30 pm GMT.

- Jobless claims fell to 2, 83,000 for the week compared to 3, 04,000 before and continuing claims increased slightly to 2.425 million,Compared to 2.367 million.

- The data reaffirmed the resilience of the US economy, moreover a solid job market. We have stressed over the articles on the strength of the US economy and our view of bullish dollar.

In this article we try to point that US job market is entering the optimal phase. Thus we believe, this leaves the Federal Reserve to consider inflation as the most important data to raise rate. This may turn the inflation data reaction to be more volatile especially in the treasuries market in the coming months.

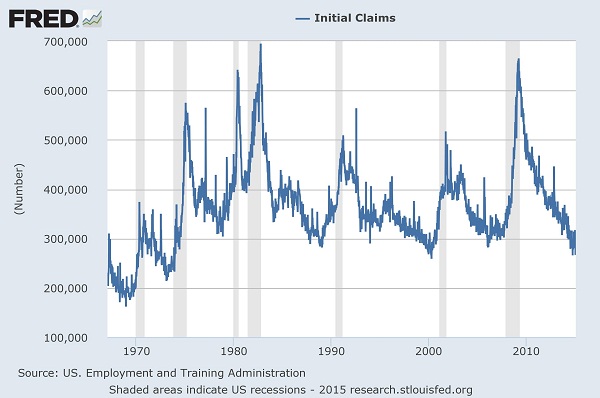

We have included a chart to show the data since 1960, to provide evidence on our view. The chart was prepared in FRED dashboard of St. Louis FED. Shaded areas in the chart represents recessionary period.

We notice that claims have fallen to the levels of 1980's and in line with the usual trend, aftermath of a recessionary period.

The dollar has come back strong today, after the fall of FED minutes last night. Dollar index is trading at 94.27 up 0.18% for the day.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand