Korean exports fell 15.8% y/y in October, worse than expected, the largest decline in the headline rate this year, precipitated by large falls in shipments of petrochemicals, auto parts, steel and vessels, as well as high base last year.

On a seasonally adjusted m/m basis, exports fell 6.1% after climbing 9.1%, alternating between contraction and growth and a sign of fragile producer confidence in the global outlook.

There was also a strong element of payback in October, after strong September pre-shipments ahead of Chuseok and Golden Week holidays in China. Today's print confirms that the underlying trend remains soft, with overall exports down 7.5% YTD.

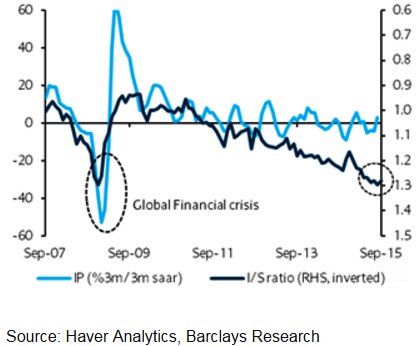

Indeed, on a per-day basis, October exports fell even more sharply, dropping 17.6% y/y, because this October had half a working day more. The key concern is still the high excess inventories, with the inventory/shipment ratio, which came in at 1.28x in September, remaining close to the 1.30x peak reached in December 2008 during the global financial crisis.

However, according to Barclays, beyond October, there are some positive factors seen that could sustain production in the last two months of Q4:

1) Stronger demand in the US for consumer electronics as the start of year-end festive demand is being approached

2) The gradual destocking of inventories

3) A ramp up in 3D memory chip output by Korean companies in China.

Some positive factors to sustain Korea's production

Monday, November 2, 2015 3:55 AM UTC

Editor's Picks

- Market Data

Most Popular

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals