LG Display is halting activities in its production plant in Paju, Gyeonggi Province. This means the company will stop manufacturing LCD TV panels as the factory is shutting down this month.

According to The Korea Times, LG Display made the decision to close its LCD TV plant in South Korea this year because it is losing its competitiveness in the flat-screen display market. Business insiders said that this was due to the growing number of Chinese rivals that are making the same product but are sold at much cheaper prices.

As a result of the Paju plant’s closure, LG Display is also expected to put an end to its production of LCD TV panels at its P7 plant. This facility was completed in 2005 and started producing the panels the following year. The products that were manufactured here made the company, the leading LCD producer.

However, Chinese rivals cropped up and flooded the market with cheaper LCD panel products. These firms received large amounts of subsidies from their government and this was why they were able to offer LCDs at much lower prices.

But while the Chinese LCD panel producers prosper, LG Display started to lose sales, and its LCD business has been dropping since 2017. It continued in the next years, and the demand declined. This has led to the decision to shut down its Paju plant.

"The P7 is going to be closed six months to a year ahead of what we have said," LG Display’s chief financial officer, Kim Sung Hyun, said during the recent investors’ earnings conference call for Q3. "We cannot clearly tell the specific time as we are communicating with our customers and employees."

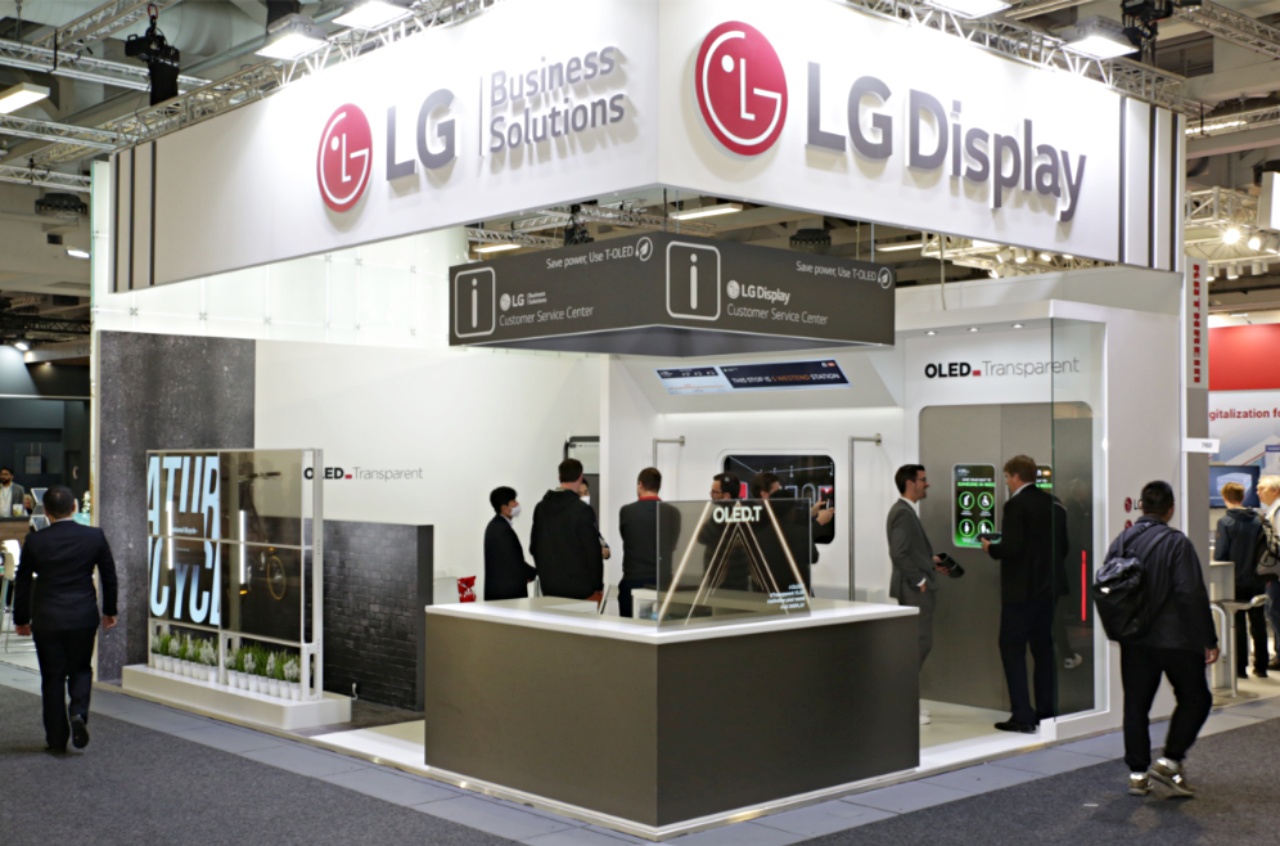

A business analyst also commented that the company may do better with its OLED business. This unit may grow fast and make up for the decline of its LCD biz. "In the second half of the year, it is expected that the company will make an operating profit of 900 billion won by improving the panel profit ratio and normalizing its OLED business thanks to the recovery of set demand," the analyst stated.

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny

ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications  Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes

Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand

Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea

Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal

Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal  Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge

Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge  FedEx Faces Class Action Lawsuit Over Tariff Refunds After Supreme Court Ruling

FedEx Faces Class Action Lawsuit Over Tariff Refunds After Supreme Court Ruling  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens

Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA