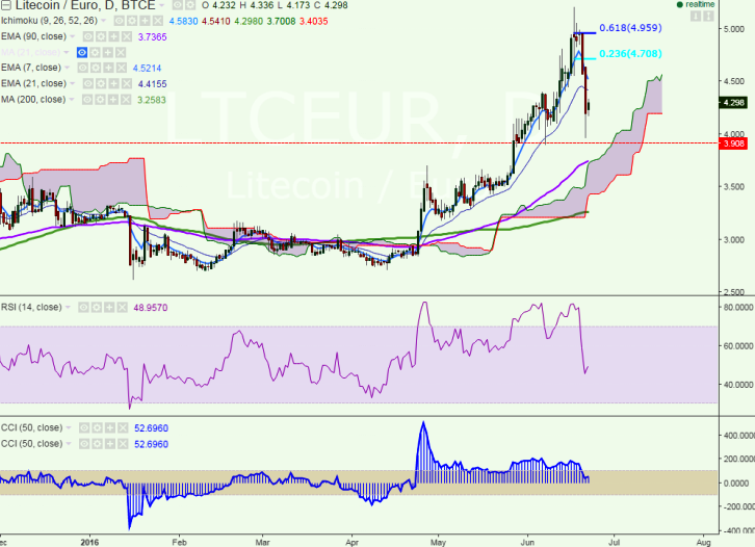

LTC/EUR has recovered slightly on Wednesday after its plunge. The pair has formed almost a double bottom near 3.90 and slightly recovered from that level (BTCE). It is currently trading around 4.25 at the time of writing.

Short- term trend- bearish

Ichimoku analysis of daily chart shows:

Tenkan-Sen level: 4.58

Kijun-Sen level: 4.41

Trend reversal level - (90 day MA)- 3.72

Long-term trend remains to be bullish. ETH/EUR faces strong support at 3.90(Jun 7th low) any further weakness only below this level. So light jump till 4.95 is possible.

Major resistance is at 4.42 (21 days EMA) and a break above targets 4.72 (7 days EMA)/4.95 (61.8% retracement of 5.20 and 4.55) /5.20. Short term support is seen at 3.90 and any violation below will drag the pair till 3.70 (90 day EMA)/3.25 (200 days MA).

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary