Luxury giant LVMH is considering expanding its production in the United States, CEO Bernard Arnault revealed, highlighting the country’s "wind of optimism" compared to the "cold shower" of higher corporate taxes in France. While LVMH is renowned for its "made in France" luxury goods like handbags and champagne, its U.S. production remains limited to three Louis Vuitton workshops and select Tiffany jewelry-making sites.

Arnault, LVMH’s primary shareholder, expressed openness to growing the company’s U.S. footprint, citing strong encouragement from American authorities and favorable tax conditions. Speaking after presenting quarterly results, Arnault stated that expanding in the U.S., a key market accounting for 25% of LVMH’s sales, is under serious consideration.

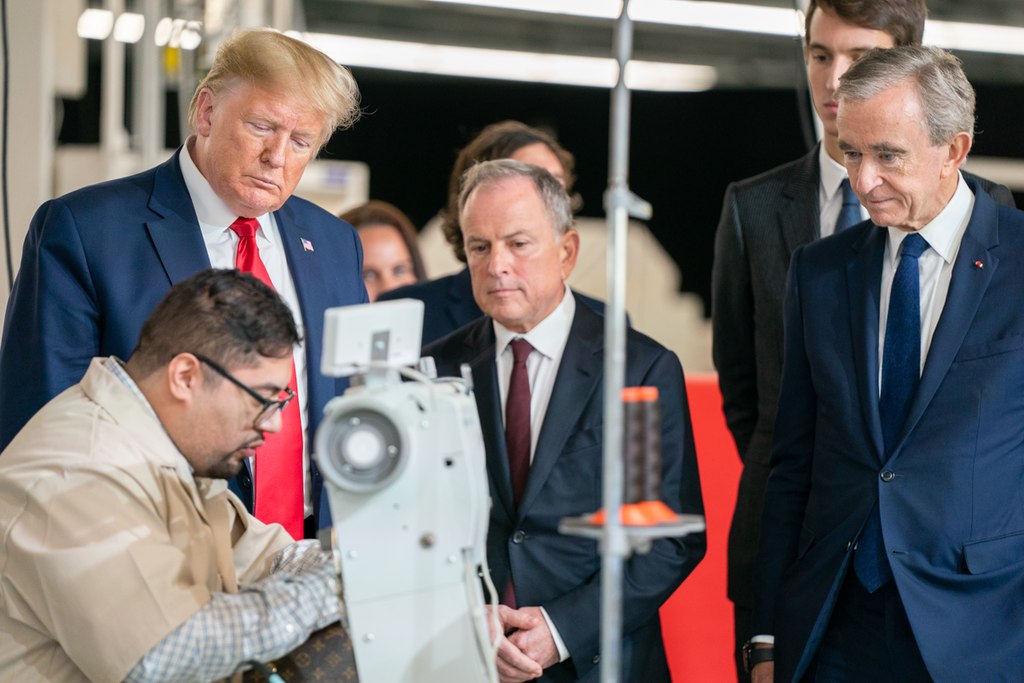

Arnault and his family recently attended President Donald Trump’s second-term inauguration, sitting among prominent figures like Elon Musk and Mark Zuckerberg. Arnault has maintained a long-standing relationship with Trump, previously inviting him to inaugurate a Louis Vuitton workshop in Texas during Trump’s first term.

The U.S. market’s dynamism contrasts sharply with France’s bureaucratic challenges and plans to tax large corporations further, which Arnault criticized for being anti-business. Reflecting on his recent trip to the U.S., Arnault noted, “You feel the optimism there, but returning to France feels like a cold shower.”

LVMH employs over 40,000 people in the United States and sees the region as a strategic hub for growth, driven by supportive policies and a robust economy. As the company evaluates expanding its production capabilities, the move aligns with its vision to strengthen its global presence while navigating contrasting economic climates.

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing