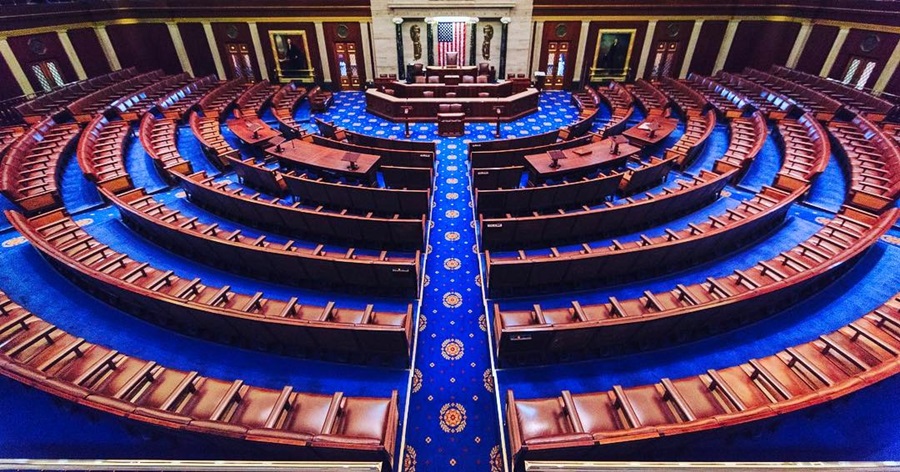

The creation of the regulation for cryptocurrency is now in full swing. The latest group to be covered by it is the U.S. House of Representatives, after the house’s Ethics Committee recently released a memorandum mandating its members to disclose any cryptocurrency holdings valuing above $1,000, Cointelegraph reported.

The memo that was issued highlights a wide scope of disclosure instructing lawmakers to reveal possession of crypto holdings, initial coin offering (ICO) involvement, and any profit derived from mining cryptocurrencies. The Ethics Committee has deemed virtual currencies a “form of currency” despite the fact that the U.S. Commodity Futures Trading Commission (CFTC) has categorized some cryptocurrencies as commodities, particularly Bitcoin.

The committee explained that their decision is “with respect to financial disclosure,” and members of the house are expected to abide by the memorandum. As such, house members and their spouses are to disclose cryptocurrencies amounting to over $1,000 filed under Assets and Unearned Income.

Meanwhile, the purchase, sale or exchange of virtual currency of more than $1,000 will be placed under “Transactions” in their yearly Financial Disclosure Statement. The memorandum further instructs that for the intent of disclosure, purchases, sales, and exchanges involving $1,000 in crypto dealings are to be filed under the Periodic Transaction Report, which is to be passed within 45 days of the transaction.

The committee said that these decisions are standing in parallel with CFTF’s stance, including that of the Securities and Exchange Commission (SEC), even though the SEC itself has deemed Bitcoin and Ethereum not securities. Moreover, the committee strongly advises house members to get in touch with them if they decide to participate in an ICO. The advice comes from the fact that the SEC is still deliberating on which stance it will take regarding this new fundraising endeavor.

As it stands, the House’s rules bar any of its members from earning more than $28,050 annually from any source unrelated to their congressional position. The committee made it clear that profit gained through crypto mining, as well as any payment made via crypto, is under the effect of this rule. Meanwhile, crypto trading will not be subject to such limitations as it’s deemed a “form of investment or unearned income.”

The committee’s decision comes on the same day as the U.S. Office of Government Ethics issued a disclosure instruction for federal workers. It mandates employees to disclose information on any crypto possession if their holdings are over $1,000. They’re also to announce any income gained through crypto if the said income exceeds $200 within the reporting period.

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast