Euro pushed higher against US dollar climbing above 1.13 levels as souring German bond yields provided support. Global bond yields broadly for third straight sessions.

Draghi stated investor should get used to higher volatility in debt markets.

While unemployment rate remains the key focus on US side. Forecast is unchanged from previous print at 6.8%.

Data showed the labor market tightening, with first-time applications for unemployment aid down last week and the number of people on benefit rolls hitting the lowest level since 2000, suggesting the Federal Reserve will remain on track to raise interest rates later this year.

Hammer pattern candlestick occurred on weekly chart to sense the upswings in near term. Both Relative strength index and stochastic evidence the convergence to the upswing price momentum. So we haven't yet smelt any shorting opportunities as of now. In our view upcoming rallies have to test upswings, fresh short build ups are not recommended at this point.

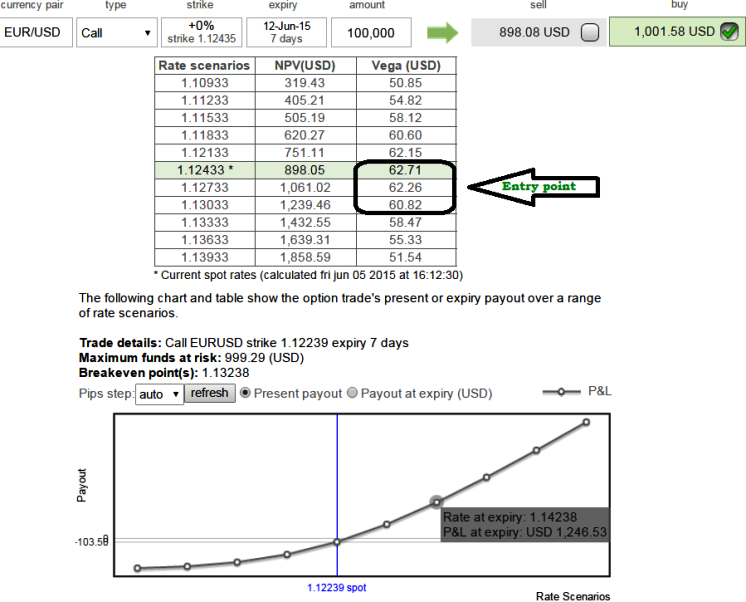

Currency Option Recommendation:

We recommend add longs on ATM digital calls of EUR/USD at Vega 0.6 levels.

At spot trading EUR/USD 1.1243 Vega is 62.71, which means for every 1% change in implied volatility the above option premium is likely to change around US$60.

Hold until intraday targets at spot 1.1260 levels, however square off intraday positions at SL 1.1180 levels.

Long Binary Vega 0.6 ATM calls EUR/USD until Jobless data on focus

Friday, June 5, 2015 11:03 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings