Since the middle of February politics has taken over as the greatest influence on the pound. Brexit risk has put considerable pressure on Sterling over the past months. On a trade-weighted basis the British currency has eased by more than 10% since mid-November. The jittery condition of the pound continues and has been clearly evidence this week as it slipped against all majors.

UK's domestic economic momentum is likely to remain supported by private consumption, thanks to higher real income. However, on a global front headwinds have picked up, in particular demand from the Emerging Markets is struggling. BoE also revised its growth forecasts lower to 2.2% for this year from 2.5% in the Nov report. Inflation developments too have been disappointing recently. February inflation report suggested it might take another 2 years for UK inflation to return to its target.

Against this background the BoE is likely to take a wait and see approach. Though the BoE continues to expect the next rate step to be a rise, market doesn’t see any rate hikes in the foreseeable future. "The BoE will likely remain cautious due to low inflation and slow wage growth and will only envisage a first rate hike at the beginning of next year." said Commerzbank in a research report.

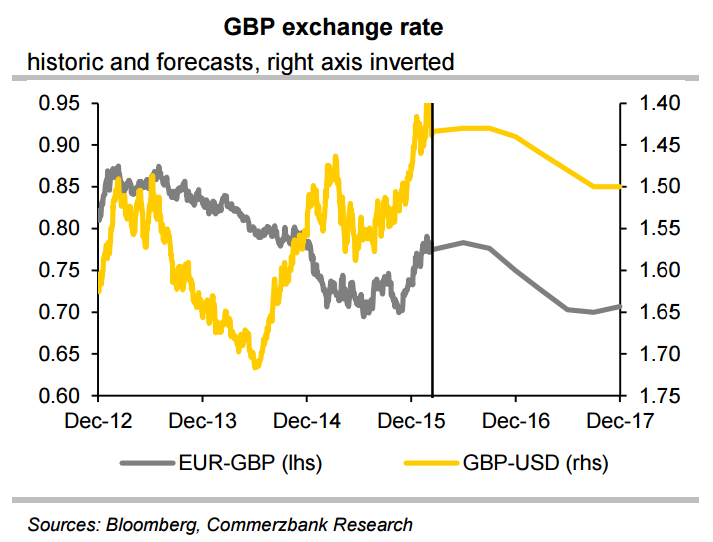

That said, the referendum on the UK remaining in the EU which will take place on 23rd June also suggests downside risks for the Sterling. Governor of the Bank of England, Mark Carney, has warned the British financial establishment that the U.K.’s potential exit from the European Union represents the biggest internal threat to Britain’s financial stability. The closer the outcome weighs in favor of a Brexit, the more the GBP/USD rate moves in favor of a stronger dollar and a collapse of the British pound.

The Fed is likely to raise its key rate more quickly than the market has currently priced in which is likely to provide considerable support for USD. On the other hand, the BoE is likely to remain careful not to cause a too strong of a GBP appreciation and therefore not only start hiking rates later but also hike in a more gradual pace than the Fed. That means that long term appreciation potential in GBP-USD remains limited.

GBP/USD was trading at 1.4080 at 1230 GMT, while GBP/JPY GBP/JPY clocks fresh 2-1/2 year lows at 151.904 before edging higher to 152.694.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary