The Fed is leaning towards rate hike mode, while the [Bank of Canada] is in a rate cut mode. The BoC is cutting its key interest rate for the second time this year, citing a larger-than-expected first half contraction and a puzzling stall in non-energy exports.

The CAD fell to 6 year's lows against US dollar at 1.294 after the BoC reduced its key interest rate by 25 basis to 0.50% faltering global economic health and low oil prices and prices of other commodities.

The BoC modifies its recent growth forecasts of their economy by mentioning the Canadian economy would sustain to full capacity by H1 of 2017.

As a great deal of optimism, it looks like Canadian currency must be hoping for crude recovery, but conversely oil prices have been slumping recently owing to abundant global supplies against weak demand. As a result the volumes of crude futures and forwards of next 6 months and 1 year expiry is showing phenomenal which in turn the demand for Canadian currency is reduced. Oil prices declined earlier due to higher supplies from OPEC. U.S. crude stockpiles are still at 461.4 million, its highest level at this point of the year in at least 80 years.

Nuke pact: Further recent nuclear deal between Iran and a group of six western powers has also been threat for crude prices. The deal is viewed as bearish for crude, as an outflow of Iranian oil could depress a market already saturated by oversupply.

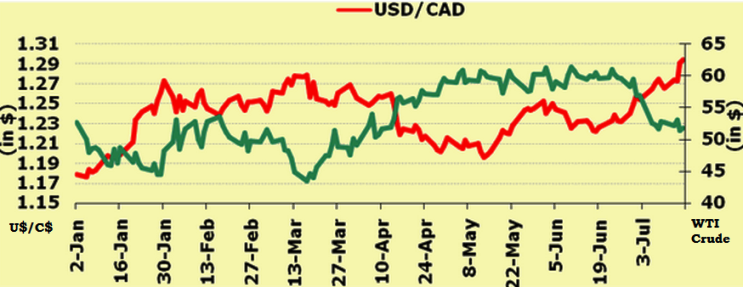

Global growth faltered in early 2015, principally in the U.S. and China. Slowing growth in China had pulled down commodity export prices, especially oil prices, which are important to Canada's economy. On the above chart, we can see that direct relationship between Loonie currencies with crude prices. Whenever, crude oil declined, loonie also declined vice-versa.

Loonie going in dangerous zone as CAD remains indirectly proportional to crude

Friday, July 17, 2015 1:08 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand