Malaysia’s underlying inflation is expected to remain low and stable through the first half of 2019. Combined with more moderate economic activity and external factors such as trade tensions, Bank Negara Malaysia (BNM) to keep the OPR unchanged at 3.25 percent for a while, according to the latest report from ANZ Research.

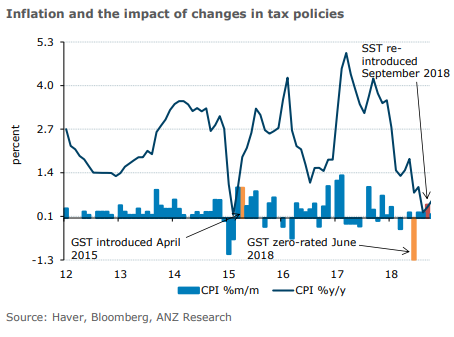

Headline CPI inflation crept up to 0.3 percent y/y in September from 0.2 percent y/y in August. On a sequential basis, headline inflation increased 0.4 percent m/m in September following a 0.2 percent m/m rise in August.

Although the Sales and Service Tax (SST) came into effect on September 1, its impact was muted presumably because leftover inventories and inputs were not subject to the price rise. The impact will likely be evident over the next few months as firms pass on the SST to consumers.

Government subsidies on RON95 grade fuel and diesel continue to shield Malaysian consumers from global oil prices and are largely responsible for the lower contribution of the transport component in recent months.

Meanwhile, on a sequential basis, food and beverage prices (which account for 29.5 percent of the basket) were up 0.5 percent m/m driven by an increase in fish and seafood prices, as well as the ‘food away from home’ subcomponent.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off