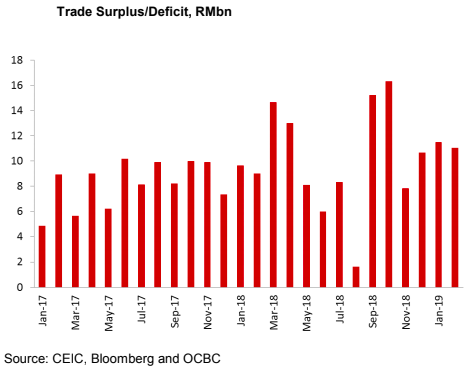

Malaysia’s trade data for February showed the country recording a surplus at RM11.06bn, little changed from the January number of RM11.52 billion. Exports did though record a decline of 5.31 percent y/y, the first since August 2018 whilst imports also fell by 9.43 percent y/y.

However, E&E exports did rise by 4.9 percent y/y, possibly proving that the country may still be in a good position to benefit in some way from the ongoing US – China trade tensions. The Malaysian E&E industry is after all known to be more flexible in quickly adapting to producing new products and hence, able to fill gaps left by China.

Anecdotal evidence also suggests that there is existing spare capacity which means the industry can more quickly respond to additional demand. However, this may also mean that the ongoing trade tensions may not lead to the sector attracting more investment.

Instead, it was commodity related exports which were a drag as petroleum related products, palm oil related products and rubber imports all fell. This could have been due to weaker commodity prices compared to the same time last year. There was an increase in LNG exports as prices were higher although export volumes were lower which possibly highlights continued production weakness in the sector.

On the import side, there wasn’t much good news as intermediate goods imports (57.4 percent of total imports) fell by 2.8 percent y/y reflecting that Malaysia is facing the effects of a global slowdown. Consumer goods and capital goods imports were similarly down too.

"Going forward, even as Malaysia may continue to run a trade surplus, import and export levels may remain subdued given the expected global slowdown in trade as highlighted by the WTO (World Trade Organization) early this week. Even if the US and China sign a trade deal, there are no assurances that they will lift tariffs immediately which is the major negative point on global trade. Oil prices at the same time face downside risk of Trump’s insistence on wanting crude prices to be lower. The palm oil sector meanwhile may be hurt by EU (European Union) attempts to restrict imports," OCBC Treasury Research commented.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains