The FY2019 (fiscal year ending March 2019) union budget, due next Thursday, February 1, will be the last full year budget of the Modi government before the general election in 2019. It will also be the first full-year budget under the GST regime.

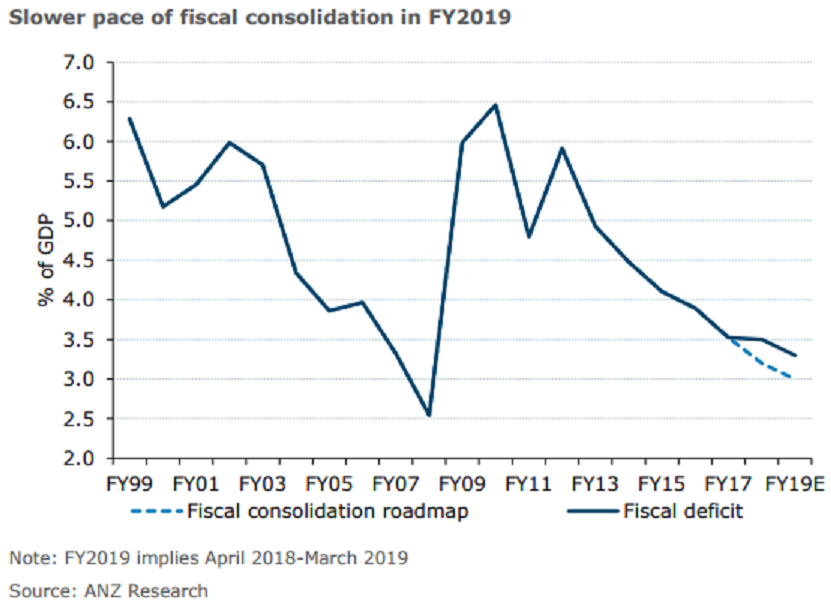

The government expected FY2019 fiscal deficit at 3.3 percent of GDP, higher than that what the initial medium term consolidation path had warranted. For FY2018, fiscal deficit is expected at 3.5 percent of GDP versus the government’s target of 3.2 percent. Also, the fiscal stance is unlikely to be inflationary on its own. The fiscal slippage in FY2018 is an outcome of lower-than-expected revenues rather than higher expenditure.

Additionally, the expenditure mix in FY2019 budget is likely to show steady growth in capex, which is less inflationary compared with revenue expenditure. Further, the CPI is expected to average 5.1 percent in FY2019, higher than our estimate of 3.6 percent in FY2018.

"We continue to expect the central bank to keep the repo rate at 6.00 percent in 2018. However, it is likely that the underlying rhetoric in the policy statements will remain hawkish," the report added.

Lastly, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed