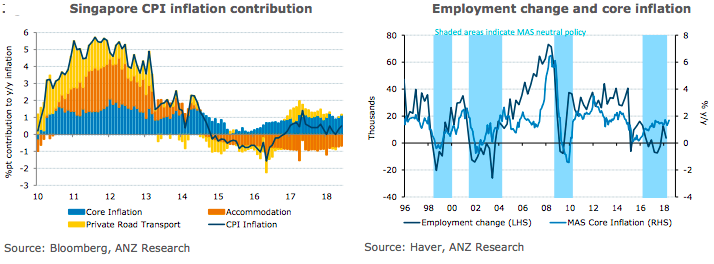

The Monetary Authority of Singapore (MAS) expects to see the county’s core consumer price inflation (CPI) to pick up towards 2 percent y/y later in the year. Based on domestic developments, a further modest tightening in October cannot be ruled out, though this will depend largely on how the external environment evolves.

The country’s CPI inflation rose to 0.6 percent y/y from 0.4 percent y/y in the previous month. On a sequential basis, CPI rose by 0.1 percent m/m in June. This was driven by higher food prices (0.2 percent m/m) and services prices – most notably holiday expenses, which increased by 2 percent m/m.

Accommodation costs appear to have halted their multi-year decline, posting a 0.1 percent m/m increase in the absence of any S&CC rebate. This suggests that accommodation costs will cease to be a drag on headline inflation on a sequential basis going forward.

Of more significance for monetary policy is the rise in core inflation to 1.7 percent y/y from 1.5 percent the previous month. This is higher than market expectations, and comes after being stuck largely within a 1.3-1.5 percent range over the previous 10 months (barring the spike driven by the tobacco tax hike in February this year). This is a further sign that improving growth is starting to filter through into price pressures, though it is still modest at this stage.

"With actual core inflation averaging 1.5 percent in H1 this year, this implies a further rise in core inflation towards 2 percent y/y later in the year. This will hinge on a continued pick-up in domestic demand and the labour market," ANZ Research commented in its latest report.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election