Moore Threads Technology Co Ltd (SS:688795), a Chinese graphics chipmaker often described as China’s potential rival to NVIDIA Corporation (NASDAQ:NVDA), saw its share price fall sharply on Friday after the company issued a warning about heightened trading risks following its blockbuster market debut. The warning triggered a wave of profit-taking, highlighting investor concerns over valuation and near-term fundamentals despite strong enthusiasm around China’s domestic AI chip ambitions.

Shares of Moore Threads dropped as much as 19% during intraday trading before paring losses to trade down 7.6% at 870.0 yuan by late Friday. Even after the pullback, the stock remains up more than 600% since it began trading on Shanghai’s STAR Market last week, underscoring the intense speculative interest surrounding China’s semiconductor sector.

In a statement released Friday, Moore Threads cautioned investors that its stock price had risen rapidly in a short period, significantly increasing trading volatility and investment risk. The company also disclosed that its newly launched chips have yet to generate any revenue, meaning the firm is still operating at a substantial loss. This admission raised questions about near-term earnings visibility, even as long-term expectations remain high.

Moore Threads is positioning itself as a key player in China’s push to build a fully domestic artificial intelligence chip supply chain. The company plans to unveil its next-generation GPU architecture—critical hardware for AI servers—at a technology conference scheduled for December 19–20 in Beijing. Investors are closely watching the event for signs of technological progress that could justify the company’s lofty valuation.

Market sentiment toward Chinese chipmakers was further pressured after U.S. President Donald Trump indicated that NVIDIA would be allowed to sell a more advanced AI chip in China. While Beijing has reportedly continued to favor domestic alternatives, the news sparked renewed competition concerns. As a result, several Chinese semiconductor stocks fell, including Semiconductor Manufacturing International Corp (HK:0981), which is down 3.6% for the week.

Overall, Moore Threads’ sharp decline reflects a broader recalibration as investors weigh long-term AI growth potential against short-term financial risks and intensifying global competition in the semiconductor industry.

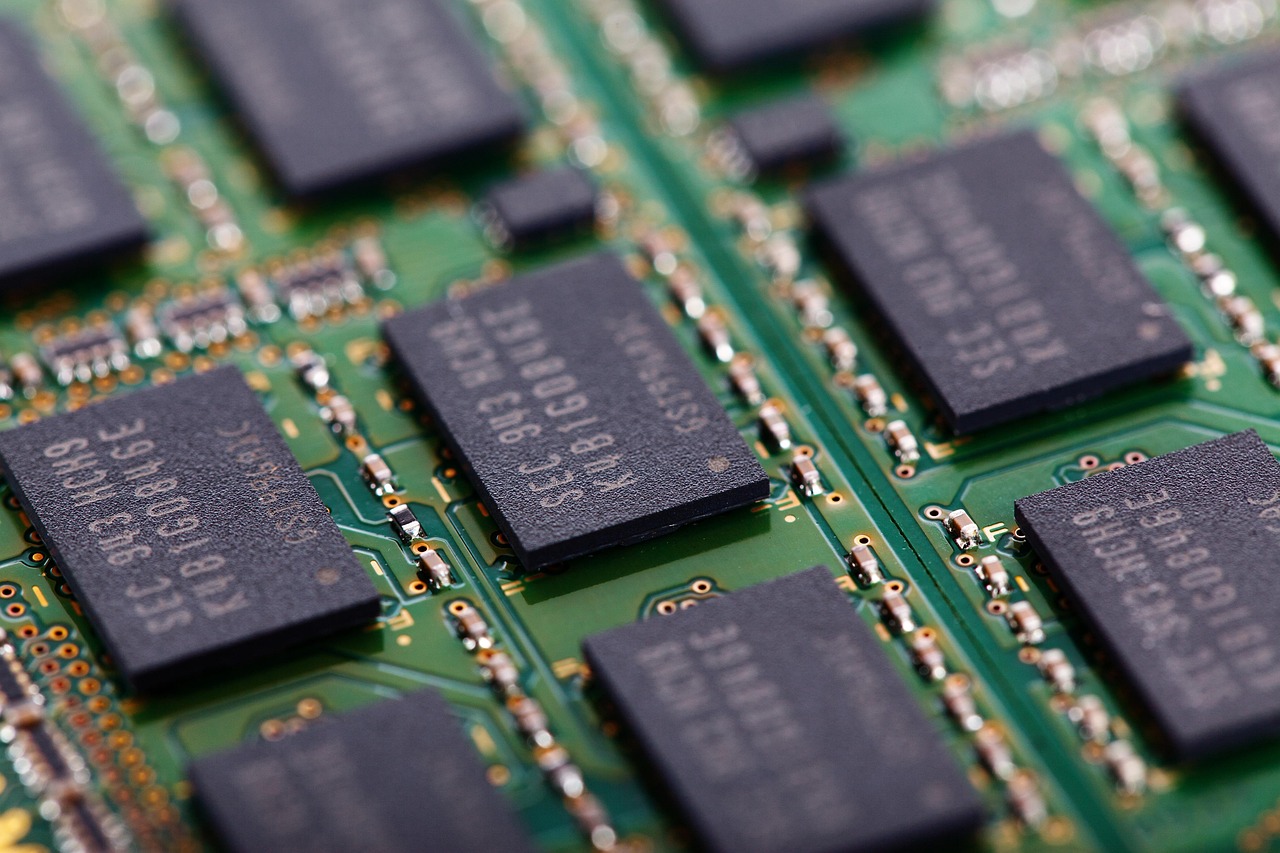

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand