- FOMC Meeting Minutes: This evening's minutes of the FOMC April meeting will also be scrutinized for variations in individual outlooks rather than providing any significant guidance on the likely timing of a rise in the policy rate which markets expect to take place before the end of the year.

- Housing starts: They were very firm in the April report at 1135K from previous 944K in March, marking a strong bounce after pent up activity through a difficult winter.

The pair was likely to test support at 0.7314, the low of May 13 and resistance at 0.7444, Tuesday's high.

Strategy evaluation:

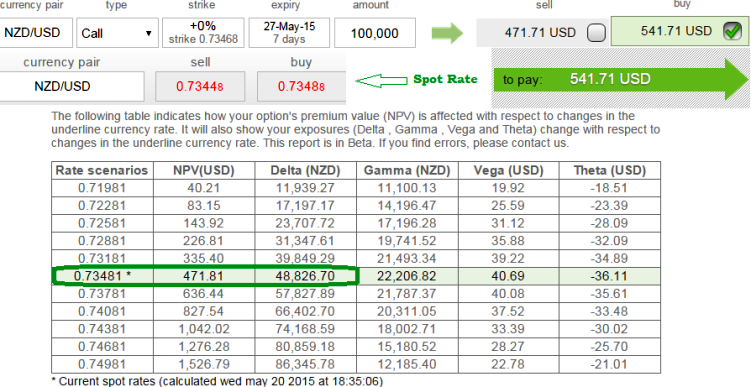

On the verge of the significant economic information as stated above, let's visualize we are buying At-The-Money calls of this pair as shown the figure.

The current NPV on ATM call option of this pair (100,000 units) looks relatively cheaper, when exchange rate of this pair was at 0.73442; the NPV was 471.81 whereas it was available at 541.71 (trading at prem.14.87%). Delta at this juncture was 48,826.70, i.e. 0.48). Hence, we conclude saying there is a 48% chance of this ATM Call finishing in-the-money on expiration.

If one thinks to buy this contract at current levels which we say this could be the ideal entry point.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate