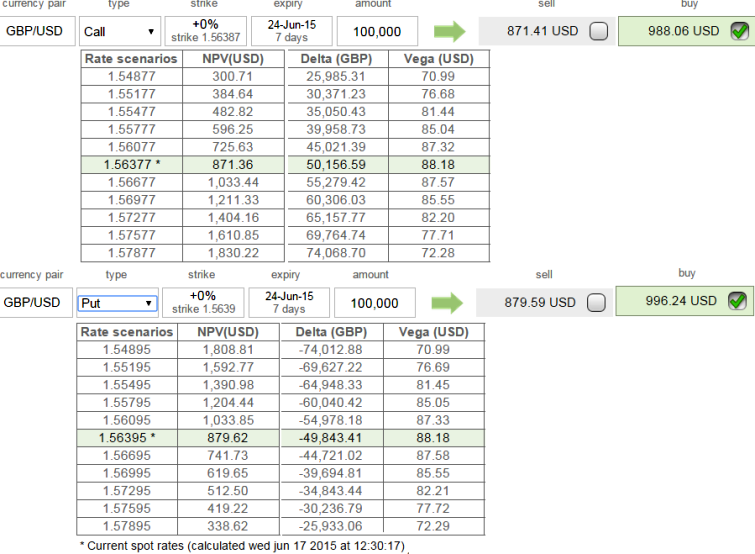

As shown in the diagrammatic representation, Bears participation in put options is equally weighed with calls.

As we can see 7D At-The-Money -0.49 delta bear one touch options are priced in at and carries vega at 88.18 while 0.5 delta calls are available at with vega 88.13.

That means bears in the underlying FX market are holding equal vested interest despite vega denotes 88.13.

This computation hints on put options are also likely to offer similar returns on every corresponding change in implied volatility in the underlying market.

To substantiate in addition NPV of calls are prevailing at 13.38% and puts at 13.28% which is almost closer.

Hence, the rationale will divulge tug of war between bulls & bears is quite tight even though in the uptrend rallies.

NPV of GBP/USD Vega ATM puts raise cautious signs for bulls

Wednesday, June 17, 2015 7:26 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings