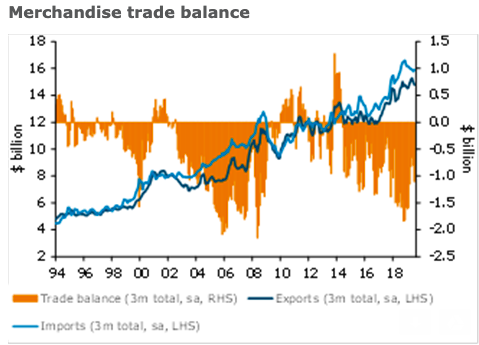

New Zealand’s exports eased slightly in July but it was the large lift in imports that dragged the trade balance down to a deficit of $685 million. Deficits are normal during the winter months as agricultural export volumes are limited at this time of the season, according to the latest report from ANZ Research. A surge in imports of petrol and machinery helped pushed the annual trade balance to -$5.46 billion.

Dairy export volumes were down just 0.1 percent on a seasonally adjusted basis, while meat exports lifted 2 percent as meat processing occurred later than normal this season. Exports of forestry products lifted 3.4 percent on a seasonally adjusted basis, indicating the recent fall in in-market prices has had little impact on export volumes.

Actual export returns for forestry products fell 18.7 percent y/y in July reflecting weaker prices. Dairy exports returns were down 16.1 percent y/y. On a seasonally adjusted basis, dairy exports were 3 percent stronger than the previous month. This lift in pricing reflects higher prices earlier in the season which are now only just showing up in export returns.

Petrol imports in July surged 47 percent m/m, on a seasonally adjusted basis, more than making up for weak data the previous month. The see-sawing of petrol imports is mainly due to the timing of ships docking. Imports of machinery also surged in July, up 23.8 percent sa, following a weak read in June.

The value of petrol imported in the year to July 2019 is up 14.5 percent on the same time period a year earlier.

"Looking forward, export volumes in August will remain curtained by low seasonal production and reduced felling of trees. By September the seasonal lift in dairy production will begin to improve export returns but this will be partially offset by lower than normal exports of meat and logs," the report added.

Image Courtesy: ANZ Research

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target