New Zealand’s unemployment rate ticked down to 4.0 percent in the December 2019 quarter – below ANZ, market, and RBNZ expectations of 4.2 percent. This followed a downwardly-revised print of 4.1 percent in Q3. These data can be volatile on a quarter-on-quarter basis, but the underlying details point to a robust labour market and household sector.

However, the unemployment rate remains within the RBNZ’s estimate of full employment (a range of 4.0-4.4 percent), consistent with underlying inflation pressures holding close to the target mid-point and ‘maximum sustainable employment’.

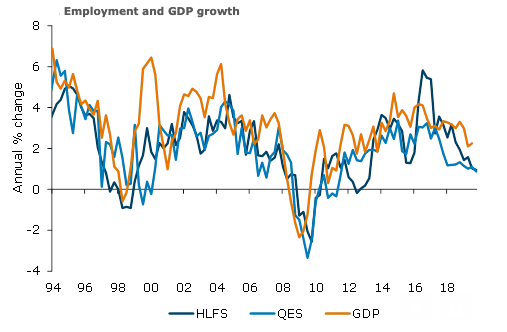

Employment growth in Q4 was weak, with HLFS employment (a survey of households) flat q/q. Annual employment growth was also flat at 1.0 percent, and continues to move within the broad range of indicators. QES employment (from a survey of businesses) was also modest. QES filled jobs rose 0.1 percent q/q, with annual growth slowing from 1.1 percent in Q3 to 0.9 percent.

But offsetting the slowing in employment growth in terms of labour market capacity pressures, growth in the working-age population continues to slow. The participation rate ticked down 0.3 percentage points to 70.1 percent, but remains at a historically high level.

In addition to employment, hours worked can provide an indication of economic activity and slack, though it can be noisy. QES hours paid (which tends to track GDP growth over history) grew 0.6 percent q/q, with annual growth lifting 0.5 percentage points to 1.6 percent.

This is consistent with our current forecast of 0.5 percent q/q (1.7 percent y/y) for Q4 GDP growth. On the other hand, HLFS hours worked (which is far more volatile) posted a 0.5 percent q/q decline, pushing annual growth from 2.3 percent to just 0.5 percent.

Public sector wage growth came in at 0.8 percent q/q, pushing annual growth from 3.0 percent in Q3 to 3.2 percent in Q4. Teacher, nurse, and police pay settlements have bumped up public sector wage growth in previous quarters.

Today’s data will be incorporated into the RBNZ’s February MPS forecasts (out next Wednesday), and are unlikely to have a material impact on their outlook, but they will certainly add to the stronger starting point compared to the November MPS, the report added.

"That said, emerging risks related to the novel coronavirus will be weighing on their thinking and assessment. Developments regarding this tragic shock are fast moving and the impacts highly uncertain. We expect the RBNZ to keep the OCR on hold at 1% next week, acknowledging these risks and emphasising their willingness to provide additional stimulus if required," ANZ Research further commented in the report.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off