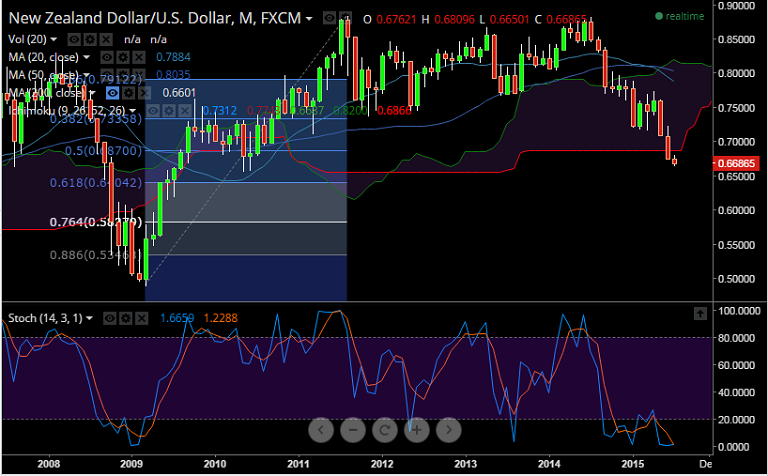

- Expectations of RBNZ OCR cuts are weighing heavily on NZD. Monthly price action has dipped below the cloud. The multi-month downtrend remains intact, with bears firmly under control.

- RBNZ easing (the OCR falling to 2.75% or lower) and Fed tightening could contribute to further NZD/USD weakness. NZIER Q2 business confidence survey is due at 2200GMT.

- NZD/USD is currently trading at 0.6684. Bears continue to target the 61.8% of the the 2009/2011 rise at 0.6404. We see no major obstacles ahead of 0.6404.

Resistance Levels:

R1: 0.6736 (Daily High July 2)

R2: 0.6794 (10 DMA)

R3: 0.6810 (Daily High Jul 1)

Support Levels:

S1: 0.6649 (30 DMA Lower Bollinger)

S2: 0.6645 (2015 & 5 Yr Low Jul 6)

S3: 0.6603 (200 MMA)