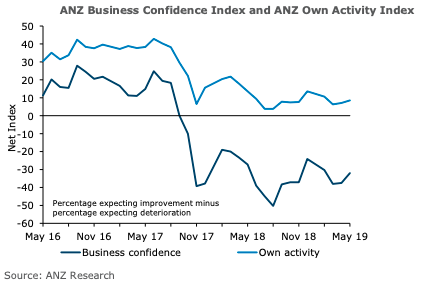

New Zealand’s ANZ headline business confidence (up 6 to net -32 percent) and firms’ views of their own activity (up 2 to net +9 percent) lifted in May’s ANZ Business Outlook, but other activity indicators were a mixed bag.

Pricing intentions and reported cost pressures lifted a touch, but inflation expectations fell to their lowest level since early 2017 (1.8 percent). Residential construction intentions fell sharply again despite the ruling out of a capital gains tax. Employment intentions in the construction sector also fell sharply, to their lowest level since 2009.

In the May ANZ Business Outlook Survey headline business confidence lifted 6 points, with a net 32 percent of respondents reporting that they expect general business conditions to deteriorate in the year ahead.

Firms’ expectations for their own activity lifted 2 point to a net 9 percent expecting a lift. Manufacturing is the most optimistic sector; construction is now the least.

Most ANZ Business Outlook activity indicators were little changed in May, at levels consistent with the slower growth the economy is experiencing. The main red flag in the survey is residential building intentions.

These fell sharply yet again, down another 7 points to a net 27 percent expecting lower activity, the weakest since 2009. The signal is no longer isolated to this one data series – employment intentions in the construction sector fell from flat to a net 22 percent of firms intending to cut jobs, ANZ Research reported.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX