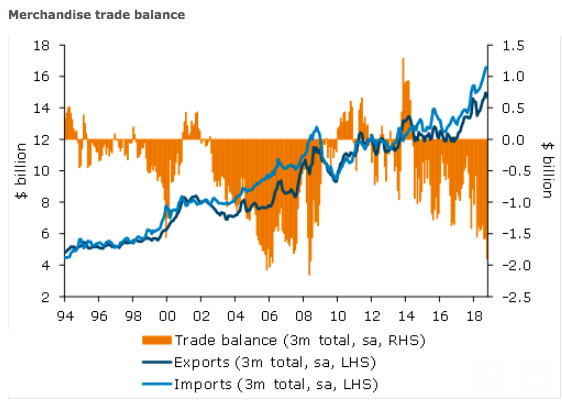

New Zealand’s monthly goods deficit was the third largest on record when excluding large items (aircraft), surpassed only by the previous two months. The annual deficit is now the highest in 11 years.

Imports reached their highest level ever of USD6.2 billion in October, mainly due to petroleum products. Exports also rose strongly as fruit (in particular kiwifruit), meat and forestry products all continued recent strength.

The unadjusted monthly trade deficit pared back USD300 million in October to USD1,295 million. Both exports and imports were slightly higher than expected; petroleum products accounted for a third of the rise in imports. Cell phones and mechanical machinery and equipment also contributed strongly.

On a seasonally adjusted basis, exports fell 6.4 percent m/m, but are hovering around historically high levels. Surprisingly, fruit exports were down 0.9 percent m/m, despite the USD165 million in total kiwifruit exports being the highest on record for an October month. Dairy, meat and forestry products all rose on strong volumes (6 percent, 13 percent and 12 percent respectively).

Seasonally adjusted imports fell 4.6 percent m/m, partially unwinding last month’s revised 9.6 percent lift. Petroleum products fell 15 percent m/m in what typically is volatile data, but major imports such as mechanical and electrical machinery and equipment (cell phones) rose 20 percent and 6 percent apiece. Textiles also rose a solid 18 percent m/m. Overall, imports items came in on the high side and paint a picture of solid domestic demand.

On a regional basis, China continues to command a higher share of New Zealand exports. Exports to China in the past 12 months were $13.5 billion, representing 24 percent of all goods exports. This includes large chunks of New Zealand’s major export groups such as dairy, forestry, meat and fruit exports. By contrast, exports to Australia are just 16 percent of total goods exports.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference

Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations