- As per latest data, both export and import deteriorated in New Zealand. Export fell to $ 3.7 billion from previous $ 4.4 billion. Import also fell to $ 3.64 billion from a previous $ 4.6 billion.

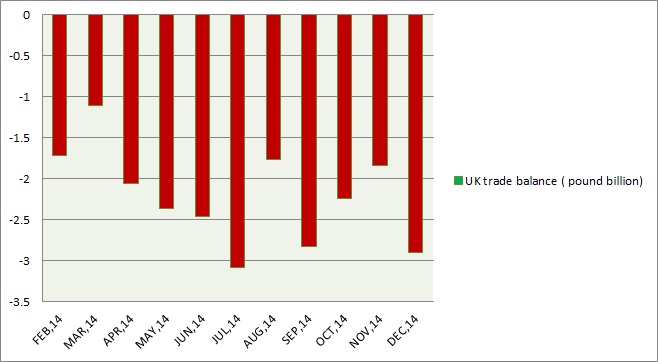

- In January the trade balance enjoyed a surplus of $ 0.56 billion but deteriorated sharply on a yearly basis. Chart is attached explaining the data path. All values in chart are in $ billion.

Analogy -

- New Zealand is a stable but export driven economy mainly agricultural and forestry. The slowdown in China & Euro zone is not bearing well for the economy.

- New Zealand even experiencing slower demand at home. House prices fell across the country in recent time as well as headline CPI.

- Reserve Bank of New Zealand (RBNZ) so far kept the interest rate at highest in developed world at 3.5 percent and after disappointing data will be in no hurry to raise the rates. It so far mentioned the rate hike to be the next probable path.

- As the economies across the developed world experiencing ultra-loose monetary policy, RBNZ may soon join in to reduce the pressure of much stronger New Zealand Dollar.

New Zealand dollar is expected to remain under pressure despite recent gains from the comments of Janet Yellen. NZD/USD is currently trading at 0.7588 rejected at resistance of 0.762.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings