New Zealand’s unemployment rate is expected to see a small bounce from 3.9 percent to 4.1 percent in the fourth quarter of 2018, after last quarter’s very large, unexpected drop of 0.5 percentage point, according to the latest report from ANZ Research.

Further, wage inflation is expected to have firmed to 2.1 percent y/y, reflecting previous tightening in the labour market, the higher minimum wage, and a boost from last year’s nurses’ pay settlement. But underlying wage inflation is seen to continue to improve only gradually.

Looking through the noise, the labour market is expected to have been broadly stable in the December quarter, consistent with continued – but moderating – GDP growth and cautious hiring intentions in business surveys.

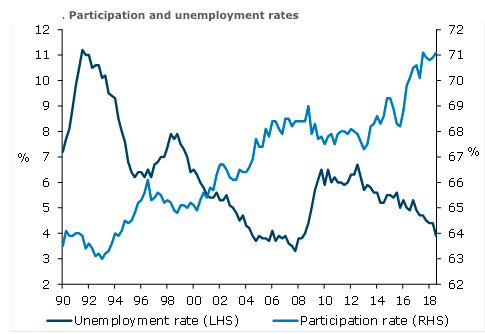

Employment growth is expected to soften from 2.8 percent to 2.6 percent y/y. In the quarter, employment is expected to have grown a soft 0.3 percent, with an element of pay-back from last quarter’s strong 1.1 percent q/q print. Labour force participation is expected to have remained elevated at 71 percent of the working-age population.

Nominal LCI private sector wages are expected to have risen 0.6 percent q/q, with the nurses’ pay settlement expected to provide a boost. Annual wage inflation is expected to have firmed from 1.9 percent to 2.1 percent y/y, with Q2’s increase in the minimum wage continuing to contribute; we estimate +0.2 percentage point from this.

"In light of this, we expect the labour market to tighten only very modestly over the medium term, as the net migration cycle eases. We expect to see continued, but not spectacular, employment growth – consistent with our view that it will be difficult for the economy to grow above trend," the report added.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves