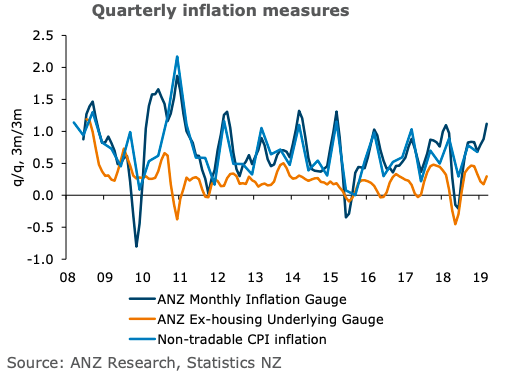

New Zealand’s ANZ Monthly Inflation Gauge dipped 0.1 percent m/m in March, but strength in the early months of the year took the quarterly increase to 1.1 percent for Q1. The Gauge has given a very accurate read on non-tradable inflation in the last two CPI prints.

Overall, 10 of the 36 subcomponents rose in March, while 6 subcomponents fell. Housing-related prices were strong in the month, with rents, purchase of housing, and property maintenance services among the top contributors. On the downside, telecommunications and accommodation services were a drag.

On a quarterly basis, strength was driven by prices for tobacco and cigarettes, rents, domestic airfares, and medical services. The regulated increase in tobacco products in Q1 contributed around half the quarterly print (0.52 percentage point), while domestic air transport contributed 0.12 percentage point. Airfare prices have been volatile, and strength in Q1 comes after a sharp drop in the December month.

As a result, the increase in airfare prices in the Gauge was stronger than usual for a March quarter. Annual growth rose to 2.4 percent, towards a level more consistent with Statistics NZ’s annual non-tradable numbers. Excluding housing-related prices, the Gauge fell 0.2 percent m/m, pushing annual growth up to 0.8 percent from 0.5 percent.

"Waning momentum in the economy means inflation pressures will soon fade. However, we could see some further strength in annual non-tradable inflation in the short term as a result of the previous build-up in capacity pressures," ANZ Research commented in its latest report.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy