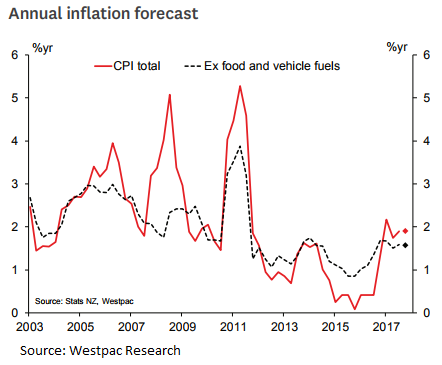

New Zealand’s consumer prices are expected to have risen by 0.4 percent in the December quarter, led by higher fuel prices and other transport costs. This would maintain the annual inflation rate at 1.9 percent, very near to the 2 percent midpoint of the Reserve Bank of New Zealand’s (RBNZ) target range. Excluding the volatile food and fuel categories, annual inflation is seen to remain at a more modest 1.6 percent, Westpac Research reported.

The most significant price increases over the December quarter were related to travel. Petrol prices were up 6 percent over the quarter, and diesel prices rose 10 percent, reflecting a rise in world oil prices and a weaker New Zealand dollar. Petrol prices are at their highest since the September 2015 quarter.

The largest negative contribution will be from a 1.6 percent drop in food prices, led by an 18 percent drop in vegetable prices. This is entirely a seasonal phenomenon – in seasonally adjusted terms, food prices are expected to be up 0.3 percent for the quarter. Food price inflation picked up over 2017, but much of that was due to poor weather playing havoc with some crops.

"Aside from fuel and food, we expect that tradables prices remained subdued. It’s likely that the rise in the New Zealand dollar earlier in 2017 was still suppressing import prices at the end of last year," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX