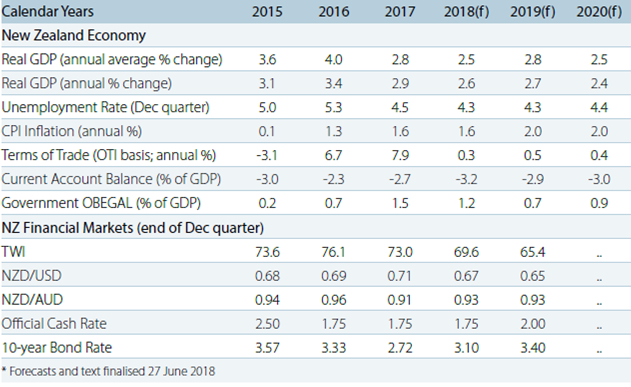

New Zealand’s risks to the domestic inflation profile are skewed to the downside, which could see the Reserve Bank of New Zealand’s (RBNZ) hiking cycle pushed even later. The central bank’s Overnight Cash Rate (OCR) is expected to follow the price direction, according to the latest report from ANZ Research.

This economic cycle has been characterised by strong rates of GDP growth yet stubbornly low inflation. But the economic landscape is expected to be shifting. The economy is going through a softer patch and we expect it will struggle to grow above trend from here.

"On the other hand, cost pressures are increasing and look set to push inflation higher, though likely in a gradual fashion. On balance, and all else equal, we expect inflation will increase and that the OCR will eventually rise: we are pencilling in a hike for November 2019," the report added.

Chinese demand for New Zealand exports continues to hold up, but growth is expected to slow. The ECB remains cautious, but has signalled the unwinding of QE. The Australian housing market is navigating some headwinds and this will likely dampen domestic demand. But other drivers are expected to keep the economy ticking along.

An inactive and cautious RBNZ, together with rising global yields should lead to domestic curve steepening, and a less favourable backdrop for borrowers overall, but it won’t be a smooth ride. The NZD is on the back foot, and further weakness is expected as the implications of a turn in the global liquidity cycle continue to play out. The NZD/AUD remains in a broad range-trading environment.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations