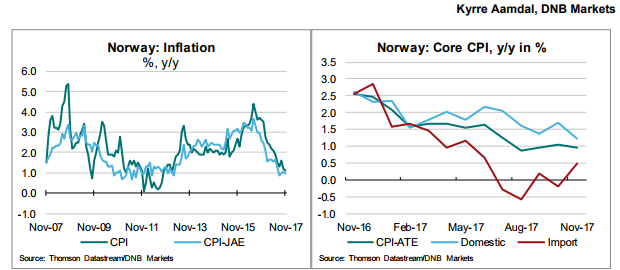

Norway’s core inflation in November fell only 0.1 percentage point from October, but was clearly weaker than expected. One reason was the highly volatile air fares, but food prices have developed weaker than normal since summer.

The weakening of the NOK may contribute to lift imported inflation during the spring next year, but if NOK again appreciate and with the outlook for modest wage growth, Norges Bank will face difficulties in lifting inflation to the target over the next years. We expect therefore Norges Bank to lag the ECB and increase rates in Q3 2019.

Regarding Norges Bank’s monetary policy meeting this week, the cutoff date for the projections was probably last Friday and today’s figures will not affected the presented rate path. If so, Norges Bank will probably present a rate path indicating rate hike early 2019. But today’s figures are arguments for a lower rate path and if accounted for will make it easier for Norges Bank to present only a moderate increase in the rate path.

Domestic core inflation fell from 1.6 percent y/y in October to 1.2 percent in November, partly pulled down by falling food prices. Imported inflation rose to 0.5 percent y/y in November from -0.2 percent in October. Higher prices on clothing pulled imported inflation higher. Total inflation (CPI) was 1.1 percent y/y in November. Norges Bank projected 1.4 percent in its September report. Electricity prices rose 8.1 percent m/m and fuels rose 6 percent m/m.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure