Nvidia (NASDAQ:NVDA) plans to spend hundreds of billions of dollars on U.S.-made chips and electronics over the next four years, CEO Jensen Huang revealed in an interview with the Financial Times. The company expects to procure around $500 billion worth of electronics, with several hundred billion produced domestically.

Huang noted that Nvidia now manufactures its latest AI systems using U.S. suppliers, including TSMC (NYSE:TSM) and Foxconn, reinforcing its commitment to bolstering domestic production. He also acknowledged growing competition from Chinese tech giant Huawei.

Nvidia’s strategy aligns with a broader push by major tech firms to localize supply chains amid rising geopolitical tensions and U.S. trade policies. Companies like Apple (NASDAQ:AAPL) have also pledged substantial investments in the U.S. to reduce dependence on foreign manufacturers.

Huang expressed confidence that the Trump administration could support the U.S. AI sector, particularly as Nvidia ramps up production of its Blackwell AI chips domestically. His comments come as the U.S. implements strict trade tariffs, prompting firms to seek alternative supply sources.

TSMC, a key Nvidia partner, has significantly expanded its U.S. manufacturing under the Biden-era CHIPS Act, securing billions in government incentives to strengthen semiconductor production.

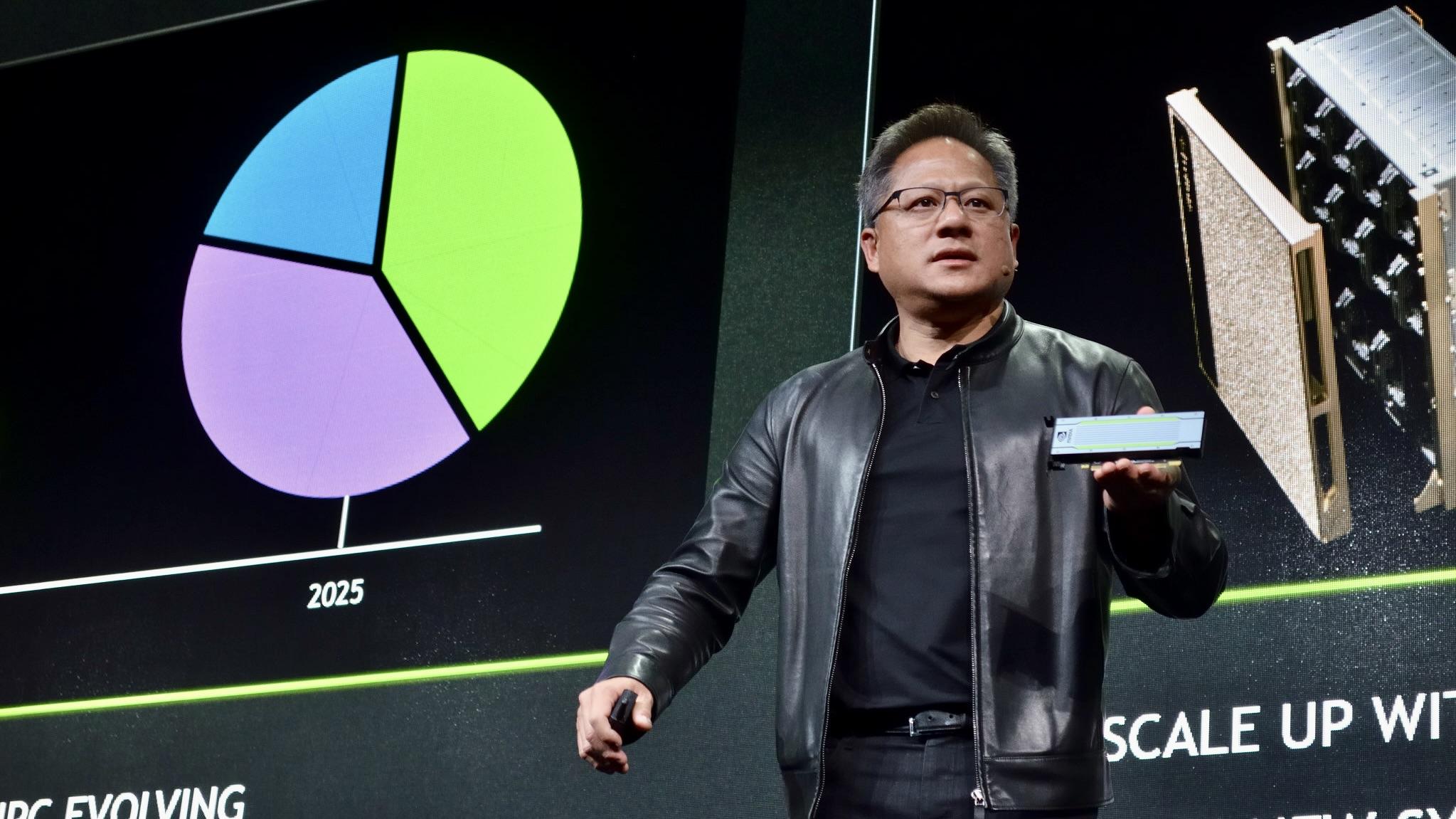

Earlier this week, Huang introduced Nvidia’s next-gen Vera Rubin AI chips, further solidifying the company’s leadership in the booming artificial intelligence sector.

Nvidia’s massive investment underscores its commitment to U.S. manufacturing, AI innovation, and securing a competitive edge in the evolving global tech landscape.

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised