The outlook for strong investment growth and further renewables capacity, particularly in regional areas of Australia, is very strong, according to the latest report from ANZ Research.

Renewable projects have added to Australian business investment, and are now contributing around 16 percent of major projects capital spending. Renewables have become a bigger share of electricity generation as investment has risen, putting downward pressure on electricity prices.

Their increasing share will create challenges for grid stability until battery capacity is more developed, and this remains a policy issue. Investment in major renewable energy projects has reached a record level, the report added.

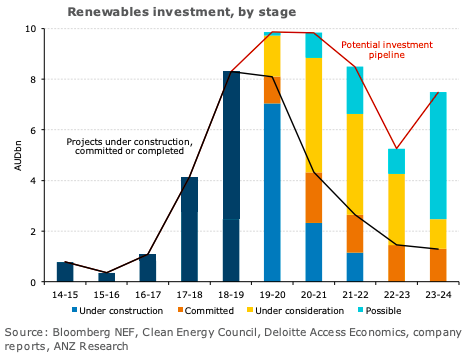

Of the major renewable energy projects, the total capital spend in 2018-19 was estimated at AUD8.3 billion. The potential pipeline is expected to grow to close to AUD10 billion in 2019-20 and 2020-211, up from below AUD2 billion in the mid-2010s.

Prior to 2017, the backdrop for large renewables investment was not as supportive as it is now. Demand for electricity was soft and even fell in 2011-12 and 2012-13, following the global financial crisis (GFC ) and the fading mining boom.

Hydro continues to be Australia’s largest contributor to renewable generation, with a 36 percent share in 2017-18. Wind contributed 34 percent of renewable electricity in 2017-18 and solar 23 percent. Australia’s only geothermal plant closed in 2016-17.

"We expect renewables investment to grow further. This is based on the current strong pipeline of projects, reflecting pent-up investment appetite, corporate sourcing of renewable energy, ongoing technological improvements including in battery storage, and pro-active government policies," ANZ Research further commented in the report.

Meanwhile, another mega-project is the Asian Renewable Energy Hub, proposed by a consortium, for Western Australia’s Pilbara. That hybrid wind and solar project would generate up to 15GW. The capital spend is expected to be AUD22 billion, invested over a six- to seven-year period from the early to mid-2020s. As well as supplying the local market, the hub would export to South East Asia via sub-sea electrical cables.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks