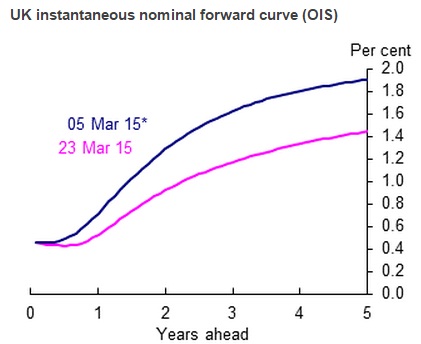

Bank of England (BOE) was expected to be the first central bank to hike rates in early 2014. However weaker economic numbers have since then continued to weigh on prices. Chart courtesy BOE.

- In recent weeks changes has been quite considerable in rate expectation as measured by overnight index swap (OIS) curve. Weaker economic dockets and change in official commentaries have pushed the expectation lower.

- OIS has fallen close to 50 basis points since March 5th over a 5 year span.

- Similar fall can be noticed across commercial bank liability curve, nominal curve and implied real forward curve.

5th March is star marked in the chart as it stands as reference point for curve position prior to the meeting by BOE.

- Chief economist of BOE recently commented that BO actions over the coming meetings might tilt either side (dovish or hawkish) as risks are broadly balanced.

- BOE officials have expressed concern over weaker economic data and relatively stronger pound.

Pound is expected to remain weak against other majors like Euro, Franc and Yen. For dollar it might take its cue from broad based dollar strength or weakness. Pound is trading at 1.498 against dollar.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand