China's CPI inflation for February surprised sharply on the downside, falling to 0.8 percent from a year earlier, data released by the National Bureau of Statistics showed Thursday. CPI fell short of expectations for a rise 1.7 percent and compared to 2.5 percent acceleration in January. The statistics bureau attributed the slowdown in consumer inflation to the Lunar New Year and cold weather.

Separate data showed China's producer price inflation beat expectations and accelerated to its fastest pace in nearly nine years in February. China's producer price inflation spiked 7.8 percent in February from a year earlier, compared with a 6.9 percent increase in January and beating analysts’ forecasts at 7.7 percent.

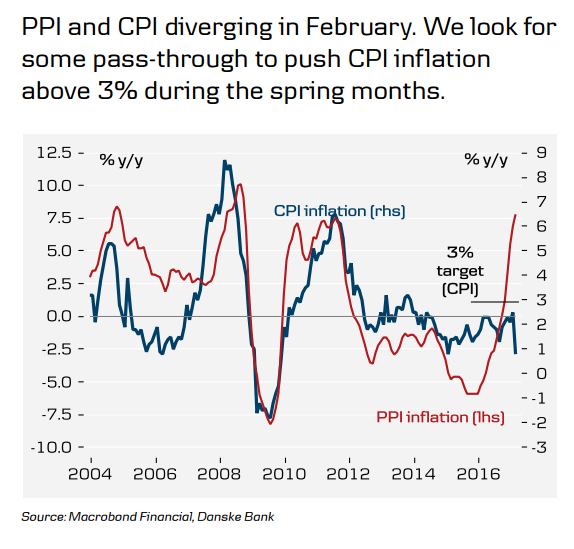

Divergence between PPI and CPI in February suggested that producers were unable to pass through higher prices to consumers. Policymakers are unlikely to be concerned about the high rate of producer price inflation as there has been little evidence of it flowing through to consumers yet. Rise in PPI inflation was not fully explained by commodity prices which suggested broader price pressure.

"Weaker CPI inflation implies downside risk to our forecast of two rate hikes in H1. However, as we still see an overshoot of the 3% target in the spring (due to pass-through from PPI), we continue to expect policy tightening," said Danske Bank in a report.

China’s new yuan loans remained relatively strong in February. New yuan loans fell sharply in February but were still higher than expected. Chinese banks extended 1.17 trillion yuan (about 169.2 billion U.S. dollars) of new yuan loans in February, down from 2.03 trillion yuan in the previous month, central bank data showed Thursday. The M2 money supply grew 11.1 percent from a year earlier to about 158.29 trillion yuan. The M1 money supply measure rose 21.4 percent year on year to 47.65 trillion yuan.

"We see little chance for monetary policy to return to easing. In addition, the PBoC should continue to re-shape the interest rate curve in the money market, with higher 7-day reverse repo rates and Medium-term Lending Facility (MLF) rates," said ANZ in a report.

PBOC set Yuan mid-point at 6.9125/dollar vs last close 6.9135. USD/CNY made intraday high at 6.9198 and low at 6.9057 levels. FxWirePro's Hourly USD Spot Index was at 90.0382 (Bullish), while Hourly CNY Spot Index was at -107.477 (Highly bearish) at 1215 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary