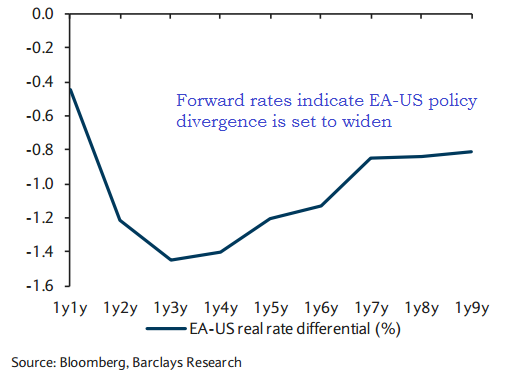

Heading into the final sprint of 2015, the divergences in central bank policies are going to be the major themes ahead of key central bank meetings in December. Nearly seven years after the previous rate cut, the FOMC is finally preparing markets for lift-off, while the ECB, the Chinese and Japanese central banks are contemplating more accommodating measures to keep their respective economies more supported. The divergence in policy outlooks relative to most of the rest of the world is expected and somewhat priced into forward rates.

Interest rate futures point to a 66 percent probability that the Fed will raise rates at its December 16-17 meeting, putting policy divergences between it and other big central banks firmly in play. Fed's hike is likely to be followed by the BoE sometime next year. All G10 central banks with the exception of the BoE and the Fed have either cut interest rates or maintained a QE programme. Going forward there is a good chance of further easing from the BoJ, RBA, RBNZ, Norges Bank, SNB and the Riksbank.

Against this backdrop the USD is likely to extend its rally in the coming months, particularly against the EUR, as the ECB is still in easing mode. While the direction of the USD is broadly shared, the length of the rally and the conviction about the direction are highly contested. USD is poised to move higher unless the FOMC counters the build-up of long USD positions with a paring back of hawkish commentary.

"We are more bearish than most on the EUR and more optimistic on the US dollar, the main disagreement is about the length of the initial hiking path, rather than the timing of the first hike. We believe that the Fed intends to deliver four 25bp hikes every other meeting when the cycle begins, reaching 1% in 12 months; and we think that it will succeed in its aim", argues Barclays in a research note.

Markets are pricing 2-3 hikes from the Fed, but it remains skeptical whether the US economy can withstand the combination of higher rates and stronger US dollar that these policies would imply. The state of the world economy in 2016 poses risks to the length of the Fed tightening cycle. Fed's interest rate cycle, and the pace at which subsequent rate hikes are executed and fears of another dip in China's output growth have significant implications for emerging markets. China and EM contribute 43% of the world's growth, together they have the potential to derail the weak recoveries in the euro area and Japan at a time when monetary policy tools seem close to losing their power.

"While we acknowledge the risks, the USD appreciation of 6.6% in REER built into our forecasts for year-end 2016 is unlikely to derail the hiking cycle on its own. We believe the US consumer will support the economy in spite of headwinds from net exports on a stronger US dollar", notes Barclays.

Data earlier showed that Euro zone GDP in third quarter slowed down further from second by 0.1%, to 0.3%, while annual pace of growth came at 1.6%, compared to 1.5% in previous quarter. EUR/USD largely muted on Eurozone GDP data, continues to hover around 1.0777 levels.

Policy divergences more deeper than currently priced by forward rates

Friday, November 13, 2015 11:10 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings