Pound traders are awaiting unemployment reading to publish around 8:30 GMT to gauge further in Pound, which has been benefiting from favorable outcome in last week's election and stronger than expected industrial and manufacturing production in March released yesterday.

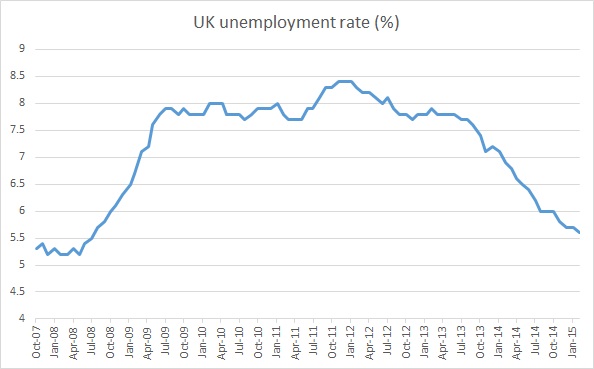

- As of now unemployment rate in UK stands at 5.6% and median estimate say's another 0.1% improvement in today's reading.

- Major focus will be on earnings growth, which has been lagging despite staggering drop in unemployed. Average earnings excluding bonus grew by 1.8% in March and including bonus by 1.7%. Today market is expecting earnings growth of 2.1% excluding bonus and of same level including it.

Impact -

- Weaker data would somewhat derail pound, though dips buying is expected as main focus for today remains Bank of England (BOE) governor Mark Carney's speech around 9:30 GMT and BOE's release of quarterly inflation report about same time.

- Stronger data might push pound upwards and again prospect of heavy buying on breakout remains limited due to the release unless earnings surpasses expectation by 0.5%-1%, which seems unlikely.

Pound is currently trading at 1.568 against dollar.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary