Pound has now fallen for nine consecutive days, unless it recovers sharply today to close above 1.525 against Dollar, which as of now seems very much unlikely given its current price at 1.52 and heavy selling pressure.

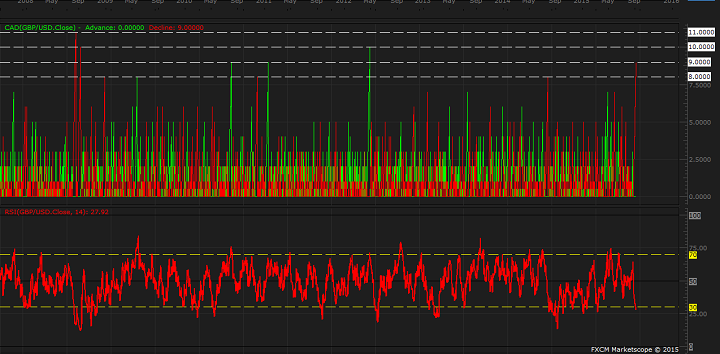

This decline if maintained till closed, will be Pound's longest since 2008, when it declined from 10 and 11 consecutive days. Pound is down about 600 points from its recent peak around 1.58 area.

Classic Oscillator RSI has fallen below 30, oversold mark for the first time since March, 2015.

However, kindly note, I am not making out any case for reversal, but pointing the extreme nature of the move, in spite of Bank of England's (BOE) rate hike communication at turn of the year.

We expect Pound to decline further against Dollar and might reach as much as 1.44 against Dollar. However given this extreme nature of the move, Pound might pose for some recovery near 1.5 psychological mark.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary