Pound has been the top performer over past few weeks, against all of its major counterparts as polls show, public shifting towards “Stay”. Financial Times’ poll of polls show, “Stay” camp has a lead of 7% over the Brexit backers and it is yet to include recent polls by ORB that shows 13% lead by the “Stay” camp, while only 3% remain undecided. If the optimism continues, Pound is likely to extend its gains post GDP, which will be released by Office of National Statistics (ONS) at 8:30 GMT.

Today’s release is the second flash estimate of first quarter GDP.

Past trends –

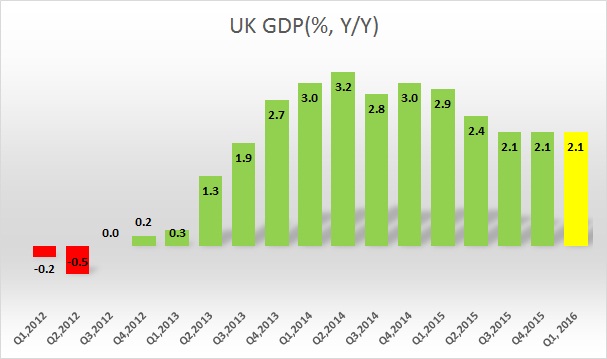

- UK GDP growth stands highest among developed economies, however that has not been sufficient enough to push pound higher as inflation remained low and services remain the only sector to have grown well above pre-crisis level.

- GDP growth reached highest level in second quarter of 2014, reaching 3.2% growth on yearly basis. Since then growth has somewhat waned. In last quarter of last year, growth was 2.1% y/y, same as third.

- According to first flash estimate, growth is likely to slow down in first quarter to just 0.4% or up 2.1% from a year back.

Expectations today –

- Today, GDP growth is expected to slow down further to 0.4% q/q and 2.1% y/y.

Impact –

- If growth comes out better than expected, Pound is likely to rally towards 1.49 resistance area, whereas any weakness in numbers likely to weaken pound but only for short time as focus is more on Brexit polls.

- Pound currently trading at 1.472 against Dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed