Here the portfolio contains the same expiration value with two different currency derivatives instruments of same underlying currency then they must have the same present value.

Else, arbitrager can go long on the undervalued portfolio and short the overvalued portfolio to make a risk free profit on expiration day.

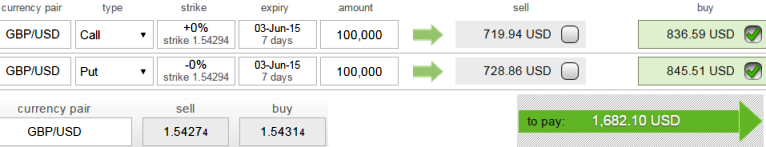

Hence, taking into account the need to calculate the present value of the cash component using a suitable risk-free interest rate, we have calculated and illustrated the Put call parity of GBP/USD straddle:

We considered ATM options while calculating Put call parity of GBP straddle structure as shown in the figure.

C = S + p - Xe-r (T- t)

= 1.5427 + 845.51 - Euler (1.5429*2.71828) - 0.02*(7)

= 846.3355

P = c - S + Xe-r (T- t)

= 836.59 - 1.5427 + Euler (1.5429*2.71828) - 0.02*(7)

= 835.4845

Where,

S = Current Exchange Rate = 1.5427

X = Exercise price (strike) of option = 1.5429

C = Call Value = 836.59

P = Put price = 845.51

e = Euler's constant - approximately 2.71828 (exponential function on a financial calculator)

r = continuously compounded risk free interest rate = Assumed at 2%

T-t = term to expiration measured in years = 7 days

T = Expiration date

t = Current value date

Note: Before jumping into a conclusion of above calculations, one has to be mindful of how the supply and demand impacts option prices and how all option values (at all the available strikes and expirations) on the same underlying security are related.

Put call parity of GBP/USD straddle

Wednesday, May 27, 2015 6:49 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate