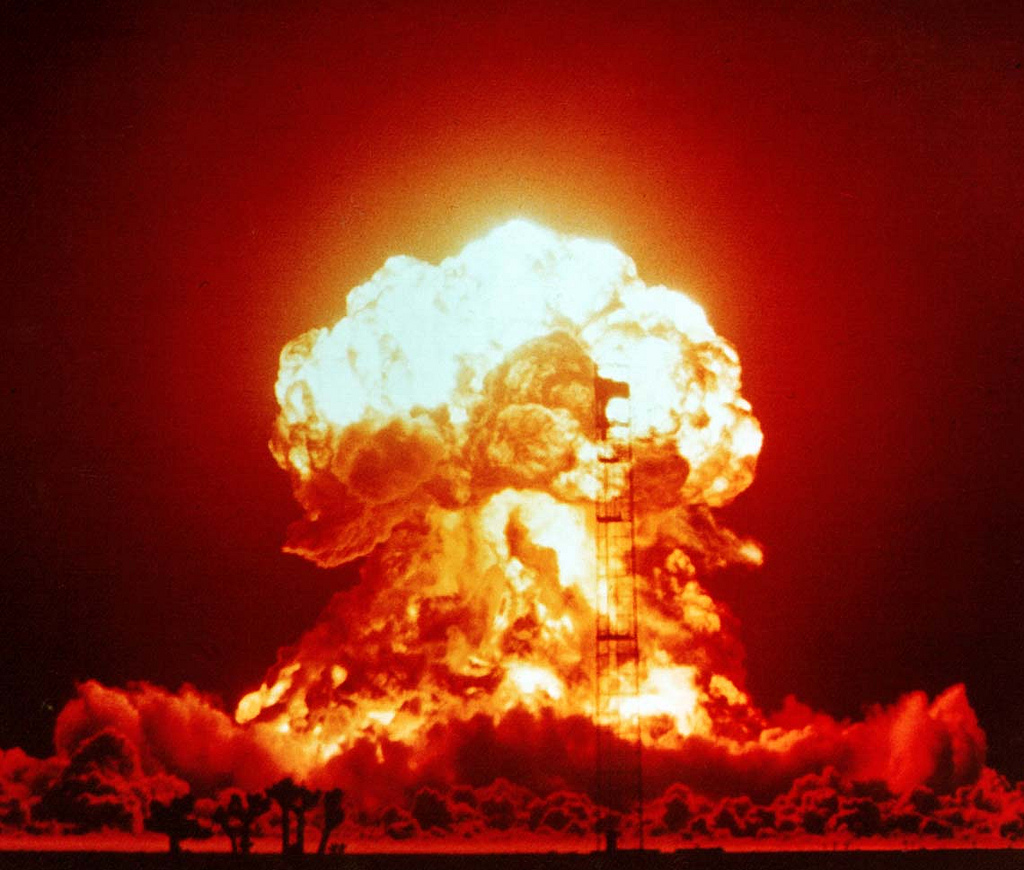

The growing tension between Qualcomm and Apple is starting to have some real ramifications, with the chip maker actually considering the nuclear option if its former/current partner doesn’t back down. This would involve banning the import of iPhones into the US, which would put the launch of the upcoming iPhone 8 in jeopardy.

Now, product import bans and Apple aren’t exactly strangers to each other as the iPhone maker made the same moves against Samsung and HTC a few years ago. This time, Qualcomm is the one threatening the American firm after Apple decided that it would no longer pay billions of dollars in dues, Bloomberg reports.

The chip maker is threatening to have the International Trade Commission move against Apple by stopping its iPhones from entering the US after being shipped from Asia. This is particularly problematic for the Cupertino tech giant since, even if the ban ultimately fails, it could lead to a delay of the launch of its iPhone 8. In the tech industry, products have been killed for less.

Now, the question that people might be asking is whether or not the ITC can actually do this. In short, yes, yes it can. However, nothing is ever that simple.

As a quasi-judicial arm that is based in Washington, the ITC certainly has the power to block Apple from bringing and selling the iPhone 8 in the country. In order to make the commission act on its request, however, Qualcomm would need to build a convincing case against Apple.

Much of its chances of actually strong-arming Apple in this matter relates to the patents that are in Qualcomm’s possession. These include the processor chips that it makes for the iPhones and the wireless technology patents that the chip maker also has.

The basic gist of the fight is really a matter of the two companies refusing to budge on their respective stances, TechCrunch reports. Apple wants to pay less in royalties but Qualcomm will not yield on this point. This is now a high-stakes game that has the potential to ruin one company or the other.

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast