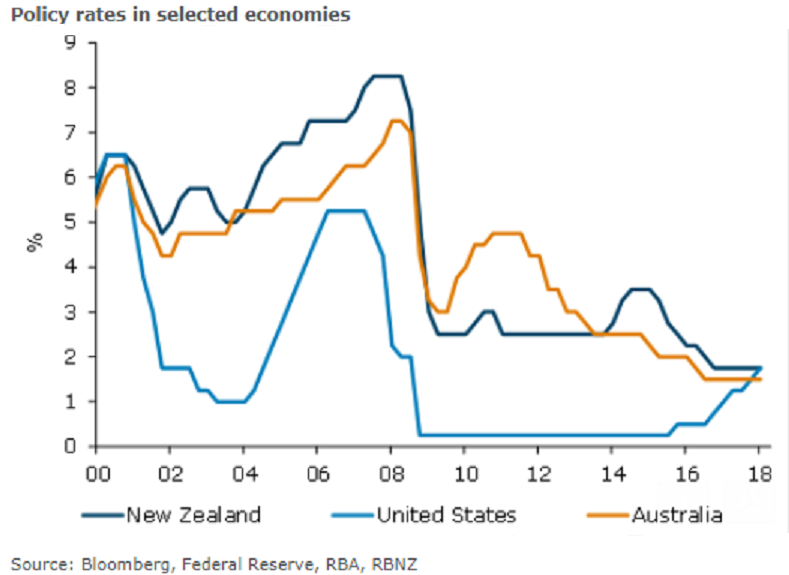

The Reserve Bank of New Zealand’s (RBNZ) Policy Target Agreement (PTA), signed early Monday aims at supporting "maximum sustainable employment" in the context of its medium-term inflation target. This policy mandate is broadly in line with those in the United States and Australia.

Although policy rates (and now mandates) in these economies are currently very similar, the policy outlooks are quite different. The RBNZ does not expect to increase interest rates until 2019, whereas the FOMC increased rates last week and expects two more hikes this year. Market pricing for policy in New Zealand is similar to that in Australia, with about a 30 percent chance of a hike priced for both by year end.

"Given the similar policy outlooks for the RBA and RBNZ, we expect the NZD/AUD to keep muddling along. However, the NZD/USD will be put on the defensive in 2018. Policy rate differentials and diminishing global liquidity suggest depreciation may be only a matter of time," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran