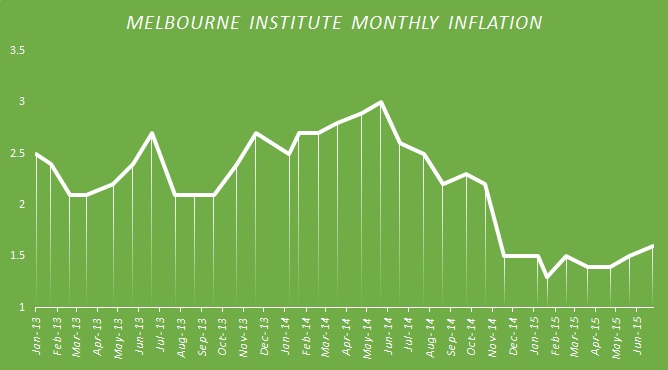

Today's report showed that Melbourne Institute Monthly Inflation Gauge rose by 0.2% in July, and 1.6% annual rate. Trimmed mean inflation rose in July by 0.1% from June and 1.5% from a year ago.

Inflation slumped from 3% in Mid-2014 to 1.3% by February 2015, however inflation and outlook has recovered somewhat since then. In recent times, producer price index and other measures of inflation has shown signs of turn around.

In July largest contribution to price rise came from food products (+5.5%), followed by Real estate (+3.3%) and non-alcoholic beverages (+2.8%).

These rises were offset by water and sewerages (-3.6%), Auto fuel (-2.3%) and alcohol -tobacco (-1.6%).

Recent turn around in inflation is likely to weigh on Reserve Bank of Australia (RBA) and policymakers might resort to wait and watch approach. Especially real estate inflation is likely to weigh on the decisions of many policymakers.

However second downturn in oil prices might weigh on inflationary pressure over the coming months.

Australian Dollar is unlikely to reverse course, even if RBA stays neutral as it will likely to use verbal intervention to push Aussie down and Chinese slowdown is likely to weigh on it.

Aussie is currently trading at 0.728 against dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand