The Q3 2015 State of the Internet Security Report released by Akamai examines the latest distributed denial of service (DDoS) and web application attack stats and trends.

According to the report, Akamai’s routed network saw a record number of DDoS attacks in the third quarter of 2015 – 1,510 DDoS attacks – an increase of 180% as compared to Q3 2014 and 23% increase over Q2 2015.

“While the number of DDoS attacks rose in the last quarter and in the last year, we observed a decrease in average attack duration, as well as average peak bandwidth and volume”, the report noted.

This decrease has been mainly due to the use of booter-stresser tools. Earlier, most DDoS attacks were based on infected bots and would last until the attack was mitigate, the malicious actor gave up or the botnet was taken down. However, booter-stresser tools makes it easy for attackers to exploit network devices and unsecured service protocols. A review of the data indicates that these tools are less capable of the big attacks that infection-based botnets produce.

“In a departure from the last several quarters, Q3 data shows the UK as the top source country for DDoS attacks, responsible for 26% of attacks. China was the second most prolific source country at 21%, the us came in third (17%), and India and Spain tied for fourth at 7%”, the report said.

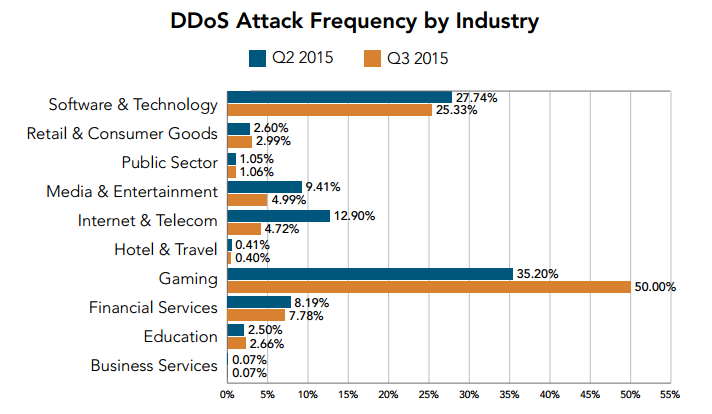

Moreover, the online gaming sector was majorly hit in the said quarter, accounting for 50% of the recorded DDoS attacks, followed by software and technology that suffered 25% of all attacks. Internet and telecom faced 5% of attacks, a drop from 13% last quarter.

The report further pointed out that in the third quarter last year, the vast majority of web application attacks—88%—came over http, while the remaining 12% came over https.

“Although https-based web application attacks represent only a small portion of all the web application attacks we observe, they still account for millions of attack alerts each quarter”, it added.

Record Number Of DDoS Attacks Recorded On Akamai Routed Network In Q3 2015 – Report

DDoS attack frequency by Industry (Source: Akamai Q3 SOTI Security Report)

Wednesday, January 13, 2016 10:08 AM UTC

Editor's Picks

- Market Data

Most Popular

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off