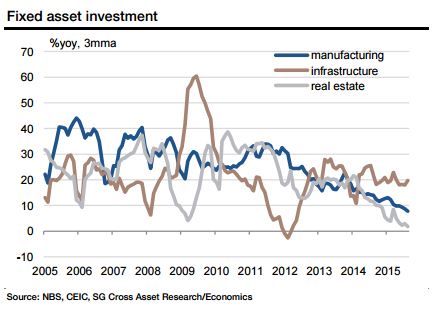

Fixed asset investment (FAI) surprisingly weakened to 9.2% yoy in August, the slowest in a decade. Manufacturing investment growth only ticked up fractionally, despite a positive base effect. Mining investment recorded a sharper decline of 8.2% yoy in August after dropping 1.7% yoy in the previous month. Most worryingly, property investment fell into contraction again from 2.8% yoy in July to -1.2% yoy in August. New starts growth improved slightly in yoy terms, albeit entirely owing to a positive base effect. Housing sales growth remained fairly decent for the fifth month, but this series seems to have lost some of its predictive power for housing construction.

Industrial production (IP) was another big disappointment. Its growth ticked up by a paltry 0.1ppt from the surprisingly slow pace of 6% yoy in July to 6.1% yoy in August, in spite of a strong positive base effect. More than four-tenth of the sectors saw growth weakening in August. Even the statistical bureau commented that the recovery was not so solid and that downward pressures on growth continued to be relatively sizable amid weak demand. Nominal retail sales printed above expectations, growing 10.8%yoy in August (vs. 10.5% in July). However, real retail sales growth remained unchanged. That said, a bright spot is that durable goods consumption strengthened, with acceleration in sales of automobiles and household goods.

All the headline disappointment occurred despite the clear presence of a stronger fiscal push. On-budget spending went from strength to strength, accelerating from 27.1% yoy in July to 28.4% yoy in August. More importantly, infrastructure investment growth jumped from 15.8 yoy in July to 21% yoy in August, on the back of another strong bank lending expansion.

Recovery is still missing for China

Monday, September 14, 2015 1:47 AM UTC

Editor's Picks

- Market Data

Most Popular

Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade

Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher

Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher  Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion  KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally

KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth

ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth