People's Bank of China (PBoC) last week devalued Yuan/Renminbi for three consecutive days. Offshore Renminbi fell from 6.2 against Dollar to trade as low as 6.59. However hovering close to 6.44 as of now against Dollar (USD/CNH).

While People's bank of China tried to assure market that it had been a controlled devaluation reflecting US monetary policy of rate hike, in reality it was a move of desperation.

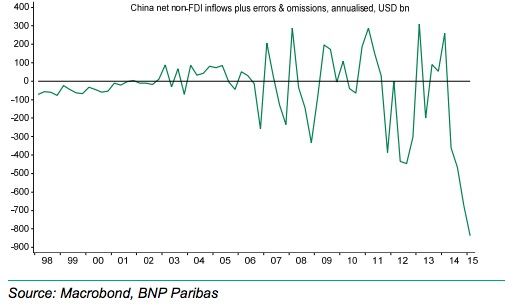

China experienced this year sharp fall of FX reserve in spite large current account surplus and positive foreign direct investment flow, suggesting rapid outflow of hot money (portfolio inflows/non-FDI flows).

The above chart from BNP Paribas, shows their estimate of hot money outflow in 2015, which according to BNP reached $209.5 billion for first quarter or at an annualized rate of $838 billion or 9.25% of GDP.

If this is true, PBoC was defending a very costly de-facto peg around 6.2 for several months had little choice but to devalue and release some of the pressure on Yuan.

PBoC's devaluation even if removes some of the pressure on Yuan it is unlikely to reverse the course of outflow of money from Chinese economy and probability stands high that it will get worse from here if devaluation spiral sets in.

In our view, PBoC is likely to have extremely difficult time, at one hand managing the Yuan de facto peg (now around 6.4), prevent tightening of the domestic monetary condition (Shibor is already on the rise) and discourage over risk taking and subprime lending.

Further devaluation, controlled or not seems very much likely.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate