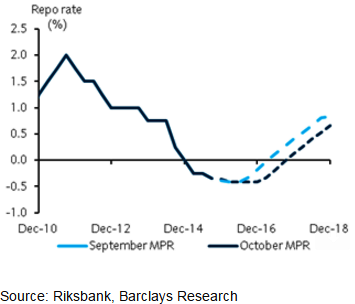

An additional 10bp repo rate cut in December after the ECB policy meeting, but remain of the view that the Riksbank is close to the end of its easing cycle.

Given the expectations for a time expansion of ECB QE in December and the Riksbank's recent reactivity to policy abroad, particularly in the euro area, the Riksbank will likely make policy more accommodative, cutting its repo rate by an additional 10bp shortly after the ECB's meeting in December.

"However, the need for additional policy stimulus will be a question and continue to think that the Bank is very close to the end of its easing cycle. The EUR/SEK forecasts remain intact, and a modest EUR/SEK depreciation is expected further ahead", says Barclays.

Riksbank likely to make policy more accomodative

Thursday, October 29, 2015 3:00 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal